Best Asset Allocation Rules are essential for every investor who wants to build wealth systematically and reduce portfolio risk. Over my years of investing, I have realized that knowing the right allocation strategies makes all the difference between average returns and exceptional wealth creation. Asset allocation is not just about splitting money between stocks and bonds.

It is about understanding how much risk you can take at different life stages and making smart decisions accordingly. In this article, I will share the most important allocation rules that have helped me and countless other investors grow their portfolios steadily.

These rules are simple, practical and backed by decades of investment wisdom. Whether you are a beginner or an experienced investor, mastering these allocation principles will help you achieve your financial goals faster and with more confidence.

Also Read: Best Investment Growth And Timeline Rules That You Should Know

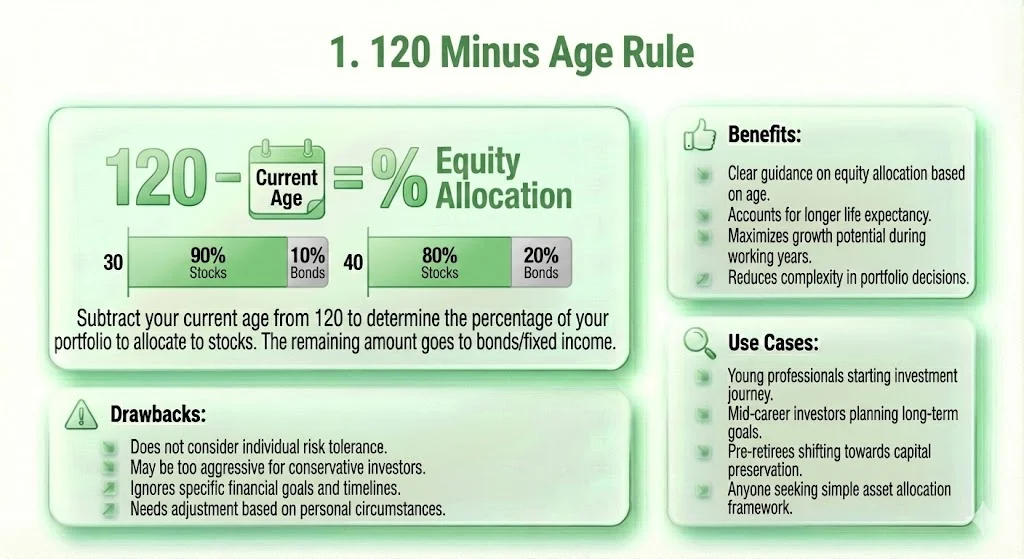

The 120 Minus Age rule is my go-to formula for deciding how much money I should keep in equity investments. This rule says that you subtract your current age from 120 and the result tells you what percentage of your portfolio should be in stocks. The remaining amount goes into bonds or fixed income assets. I find this rule better than the older 100 minus age formula because people are living longer now and bond yields are lower than before.

For example, when I was 30 years old, I allocated 90% of my investments to equities and only 10% to bonds. Now at 40, I keep 80% in stocks and 20% in safer instruments. This gradual shift makes perfect sense because younger investors have more time to recover from market downturns while older investors need stability.

Benefits:

Use Cases:

Drawbacks:

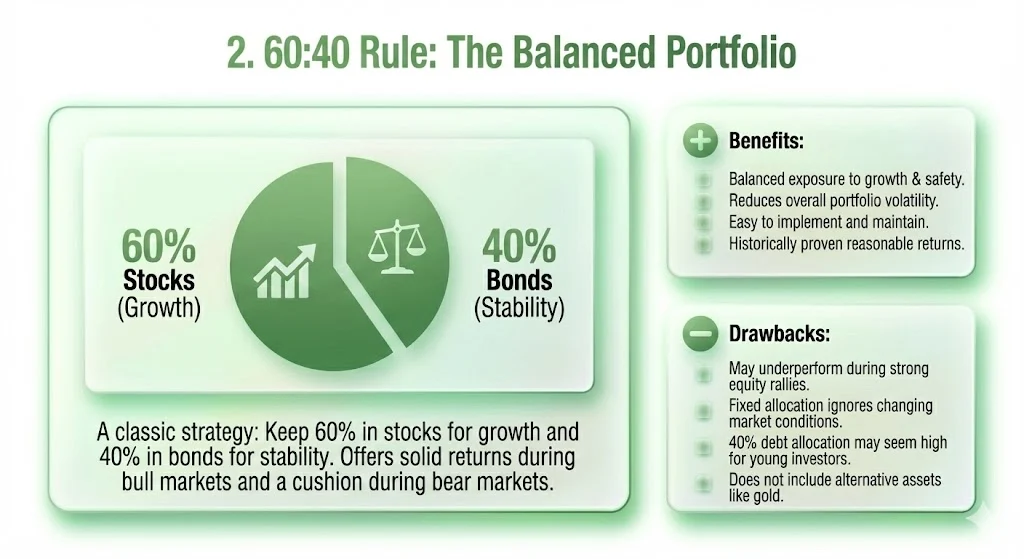

The 60:40 rule has been a classic portfolio strategy for decades and I still believe in its effectiveness. This rule suggests keeping 60% of your portfolio in stocks for growth and 40% in bonds for stability. I have seen this allocation work beautifully through different market cycles. During bull markets, the 60% equity portion delivers solid returns while the 40% debt cushion protects against severe losses during bear markets.

In 2025, this rule regained popularity as inflation moderated and bonds started providing better diversification benefits again. However, I must mention that this allocation may not suit everyone. Conservative investors might prefer flipping it to 40:60 while aggressive investors could go 80:20. The beauty of this rule is its simplicity and balance.

Benefits:

Use Cases:

Drawbacks:

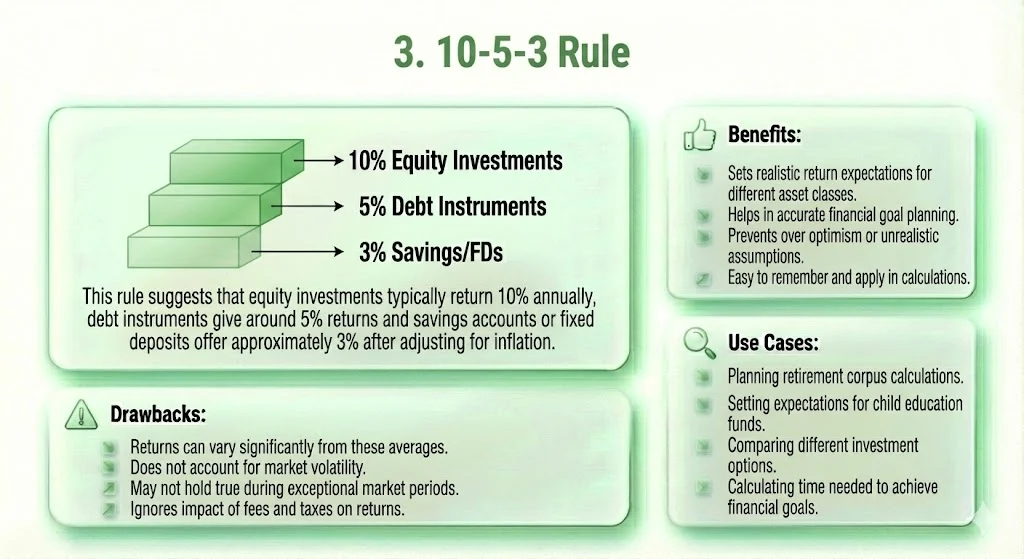

The 10-5-3 rule is specifically designed for Indian investors and I use it to set realistic expectations for my investments. This rule suggests that equity investments typically return 10% annually, debt instruments give around 5% returns and savings accounts or fixed deposits offer approximately 3% after adjusting for inflation. I find this rule extremely helpful when planning my financial goals.

When I started investing, I expected unrealistic returns from every asset class. The 10-5-3 rule helped me understand that different instruments serve different purposes. My equity mutual funds aim for that 10% growth while my PPF and bonds provide the stable 5% returns. This understanding prevents disappointment and helps in proper goal planning.

Benefits:

Use Cases:

Drawbacks:

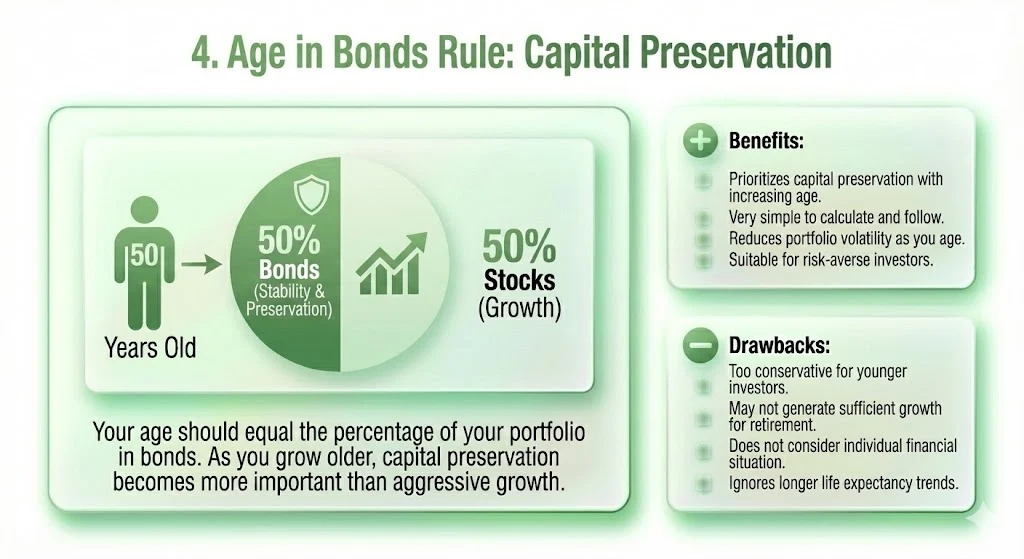

The Age in Bonds rule is straightforward and I have seen many conservative investors follow it religiously. According to this rule, your age should equal the percentage of your portfolio allocated to bonds. So if you are 50 years old, keep 50% of your investments in bonds or debt instruments. The logic is simple as you grow older, capital preservation becomes more important than aggressive growth.

However, I personally find this rule too conservative for most people. When I turned 35, allocating 35% to bonds felt like leaving too much money on the table. Many financial experts now suggest modifying this rule to age minus 10 or even age minus 20 to allow more growth potential. I recommend using this rule only if you have substantial savings already or if you are naturally risk averse.

Benefits:

Use Cases:

Drawbacks:

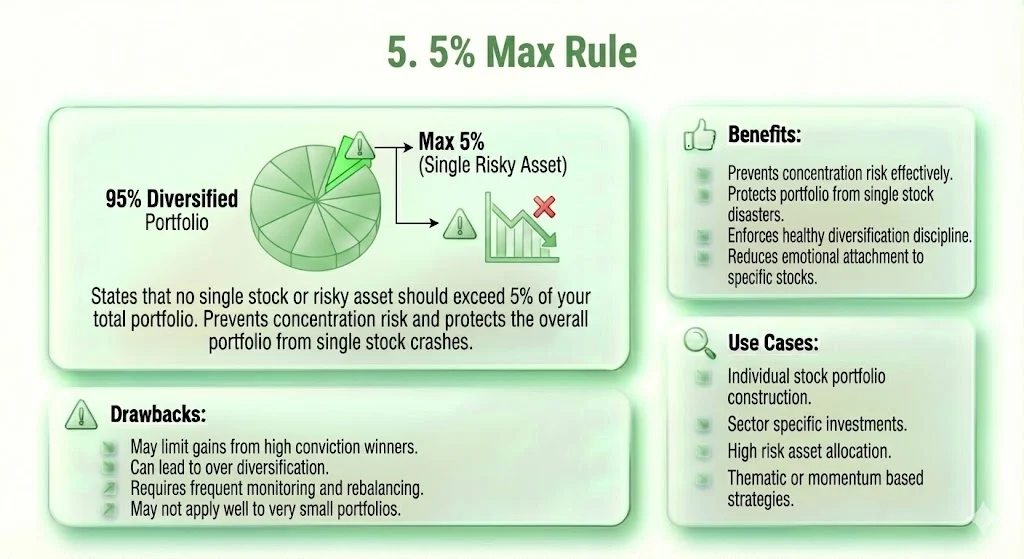

The 5% Max rule has saved me from making several costly mistakes in my investing journey. This rule states that no single stock or risky asset should exceed 5% of your total portfolio. I learned this lesson the hard way when one of my favorite stocks crashed and because I had invested 15% of my portfolio in it, my overall returns suffered badly.

Now I strictly follow this rule and it has brought much needed diversification to my portfolio. Even when I feel extremely confident about a particular stock, I resist the temptation to overinvest. This discipline ensures that even if one investment goes wrong, my overall portfolio remains stable. Some experts extend this to 10% for high conviction bets but I prefer staying within the 5% limit.

Benefits:

Use Cases:

Drawbacks:

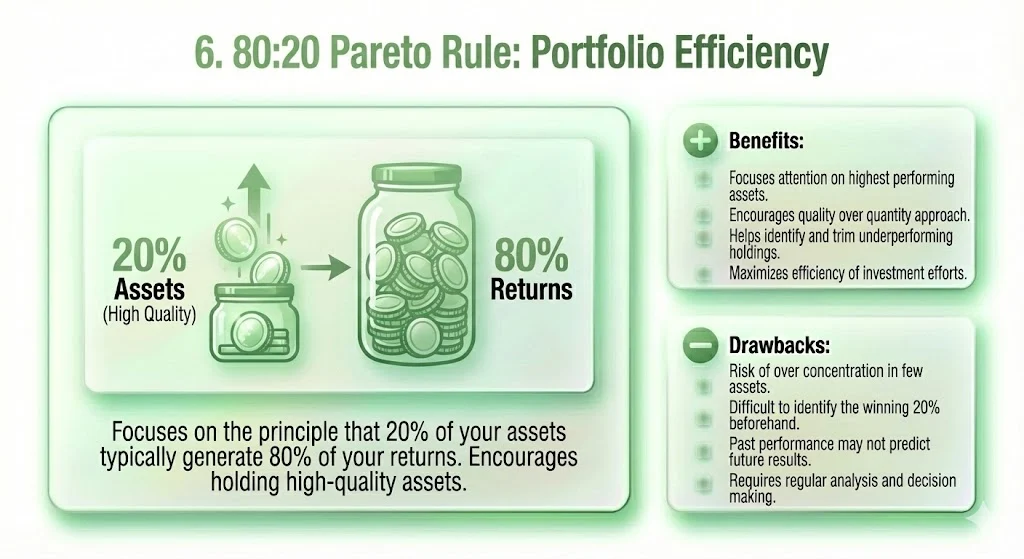

The 80:20 Pareto rule transformed how I think about my investment portfolio. This rule is based on the Pareto principle which suggests that 20% of your assets typically generate 80% of your returns. I have personally observed this pattern in my own portfolio where a handful of quality stocks and mutual funds have delivered the bulk of my gains.

This rule encouraged me to focus on identifying and holding onto high quality assets while eliminating or reducing exposure to mediocre performers. However, applying this rule requires discipline and patience. I regularly review my portfolio to identify those top performing 20% assets and ensure I am not diluting my portfolio with too many average investments. The key is finding that sweet spot between concentration and diversification.

Benefits:

Use Cases:

Drawbacks:

Asset allocation is the foundation of successful long term investing and these six rules provide a solid framework to build your portfolio. I have used these principles throughout my investment journey and they have helped me navigate both bull and bear markets with confidence. Remember that these are guidelines not rigid formulas.

Your specific allocation should depend on your age, risk appetite, financial goals and personal circumstances. The 120 Minus Age and 60:40 rules give you starting points while the 10-5-3 rule keeps your expectations realistic. The 5% Max rule protects you from concentration risk and the 80:20 principle helps you focus on quality.

I strongly recommend reviewing your asset allocation at least once a year and rebalancing when your actual allocation deviates by more than 5% from your target.

Markets will move and your portfolio will drift but staying disciplined with these allocation rules will keep you on track towards your financial goals. Start implementing these rules today and watch your investment portfolio grow stronger and more resilient over time.

Also Read: Best Investment Growth And Timeline Rules That You Should Know

Tags: asset allocation rules, portfolio management, investment strategy, equity allocation, debt allocation, investment planning, wealth creation

Share This Post