Understanding how money grows is not rocket science. In my years of tracking investments, I realized that simple formulas often beat complex strategies when it comes to planning your financial future.

These investment rules help me quickly calculate how long my money will take to double, triple or quadruple without needing fancy calculators.

They saved me countless hours and helped me make smarter decisions about where to park my hard earned savings.

Whether you are just starting your investment journey or looking to optimize your portfolio, these timeless rules will guide you. I personally use these calculations before making any major financial move and they have never disappointed me.

The beauty of these rules lies in their simplicity yet they deliver surprisingly accurate results. Let me walk you through each rule with real examples from my own experience so you can start applying them today.

Also Read: Best Retirement And Withdrawal Rules In India: Your Guide to Financial Freedom

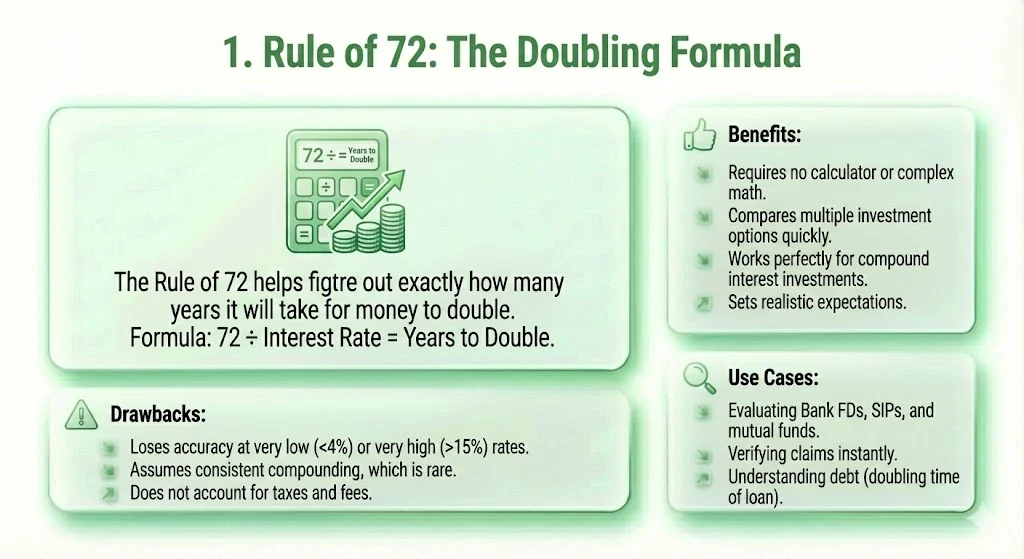

The Rule of 72 is my go to calculation whenever I evaluate any investment opportunity. This formula helps me figure out exactly how many years it will take for my money to double. The calculation is straightforward. Just divide 72 by your expected annual rate of return.

Formula: 72 ÷ Interest Rate = Years to Double

For example, if I invest ₹1 lakh at 9% annual returns, I divide 72 by 9 which gives me 8 years. This means my investment will become ₹2 lakhs in approximately 8 years. I have used this rule countless times when comparing fixed deposits versus mutual funds or stocks. The accuracy is impressive for returns between 6% to 10%.

Benefits Of Rule Of 72

I love this rule because it requires no calculator or complex math. Within seconds, I can compare multiple investment options and see which one doubles my money faster.

It works perfectly for compound interest investments like mutual funds and stocks. The rule also helps me set realistic expectations rather than chasing unrealistic returns.

Use Cases Of Rule Of 72

I use this rule when evaluating bank FDs, SIPs in mutual funds or any compound interest instrument. It is particularly useful when someone pitches me an investment scheme and I want to verify their claims instantly.

I also apply it inversely to understand debt. If my loan has 12% interest, dividing 72 by 12 tells me my debt doubles every 6 years if unpaid.

Drawbacks Of Rule Of 72

The rule loses accuracy at very low rates below 4% or very high rates above 15%. It works best for moderate returns.

Also, it assumes consistent compounding which rarely happens in real world markets. Stock market returns fluctuate wildly year to year so actual doubling time may vary. Taxes and fees also reduce actual returns but the rule does not account for them.

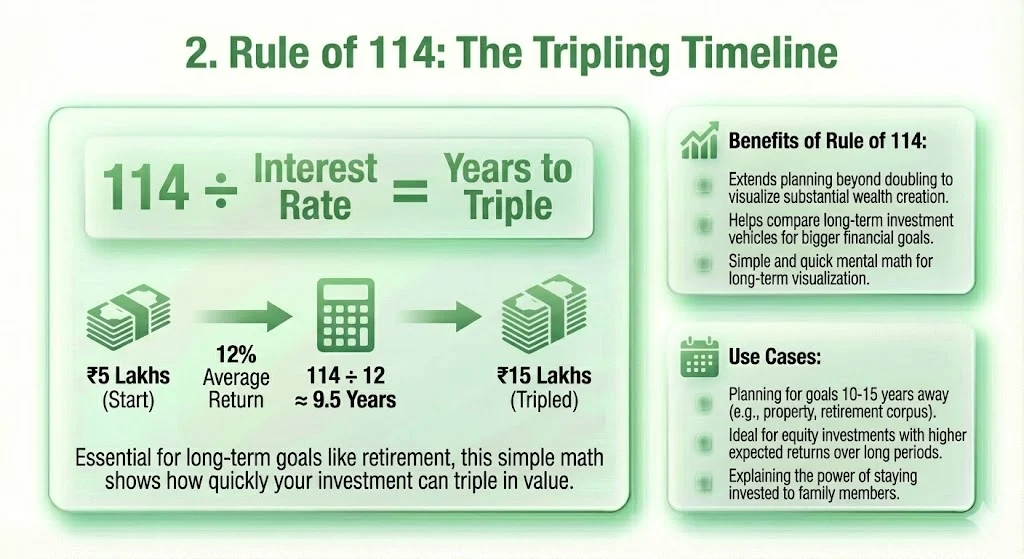

Once I understood the Rule of 72, I discovered the Rule of 114 for tripling calculations. This became essential when I started planning longer term goals like retirement or children’s education fund. The math is identical to Rule of 72 but uses 114 instead.

Formula: 114 ÷ Interest Rate = Years to Triple

When I invested ₹5 lakhs in an equity mutual fund expecting 12% average returns, I divided 114 by 12 to get 9.5 years. This told me my investment would likely grow to ₹15 lakhs in about 10 years. I find this rule extremely valuable for mid to long term financial planning.

Benefits Of Rule Of 114

This rule extends my planning horizon beyond just doubling. It helps me visualize substantial wealth creation over time. I use it to compare long term investment vehicles and understand which ones will help me reach my bigger financial goals faster. The mental math remains simple and quick.

Use Cases Of Rule of 114

I apply this rule when planning for goals 10 to 15 years away such as down payment for property or retirement corpus. It works great for equity investments where I expect higher returns over longer periods.

I also use it to explain to my family members why staying invested for longer periods makes such a huge difference.

Drawbacks Of Rule Of 114

The same limitations of Rule of 72 apply here. Market volatility makes exact predictions difficult. A 12% average return might include years of 25% gains and years of 5% losses. The rule assumes smooth compounding which does not happen in reality.

Also, inflation erodes purchasing power so my tripled amount may not have triple the buying capacity.

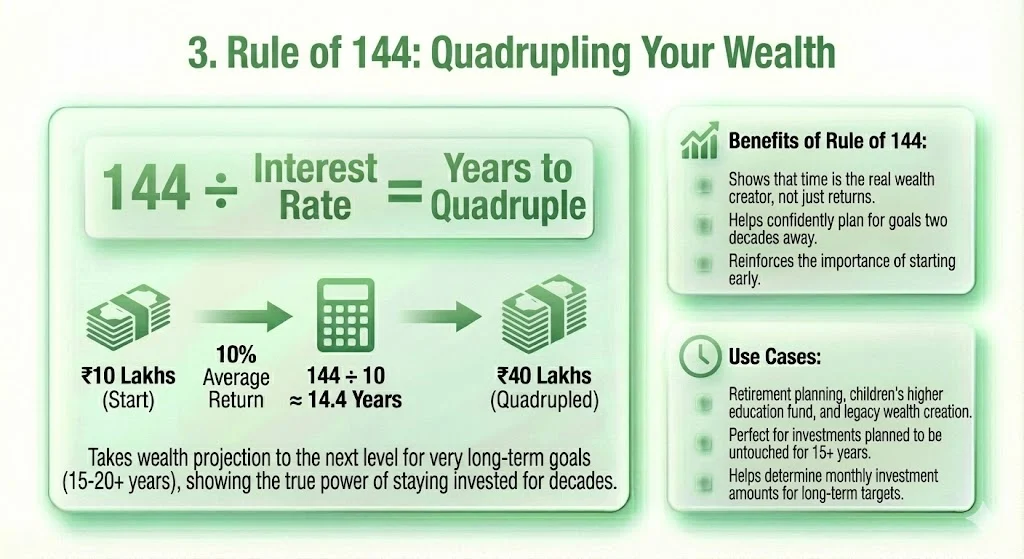

The Rule of 144 takes wealth projection to the next level by showing when investments will quadruple. I started using this rule seriously when I began planning for very long term goals spanning 15 to 20 years. The formula follows the same pattern as previous rules.

Formula: 144 ÷ Interest Rate = Years to Quadruple

My first serious equity investment was ₹10 lakhs with expected 10% average returns. Dividing 144 by 10 gave me 14.4 years.

This calculation showed me that by my 50th birthday, my investment could potentially become ₹40 lakhs. This long term perspective changed how I viewed patience in investing.

Benefits Of Rule Of 144

This rule opened my eyes to the true power of staying invested for decades. It shows that time is the real wealth creator, not just higher returns. I can now confidently plan for goals two decades away knowing approximately what my corpus will become. It reinforces the importance of starting early even with smaller amounts.

Use Cases Of Rule Of 144

I use this for retirement planning, children’s higher education fund and legacy wealth creation. It is perfect for investments I plan to never touch for 15 plus years. When I set up my child’s education fund at birth, this rule helped me decide how much to invest monthly to reach the target by college admission time.

Drawbacks Of Rule Of 144

The biggest challenge is maintaining investment discipline for such long periods. Life throws curveballs like medical emergencies or job loss that may force withdrawals. Market crashes can happen midway causing temporary massive losses. The rule assumes you reinvest all returns and never withdraw anything. Real life rarely follows this perfect scenario.

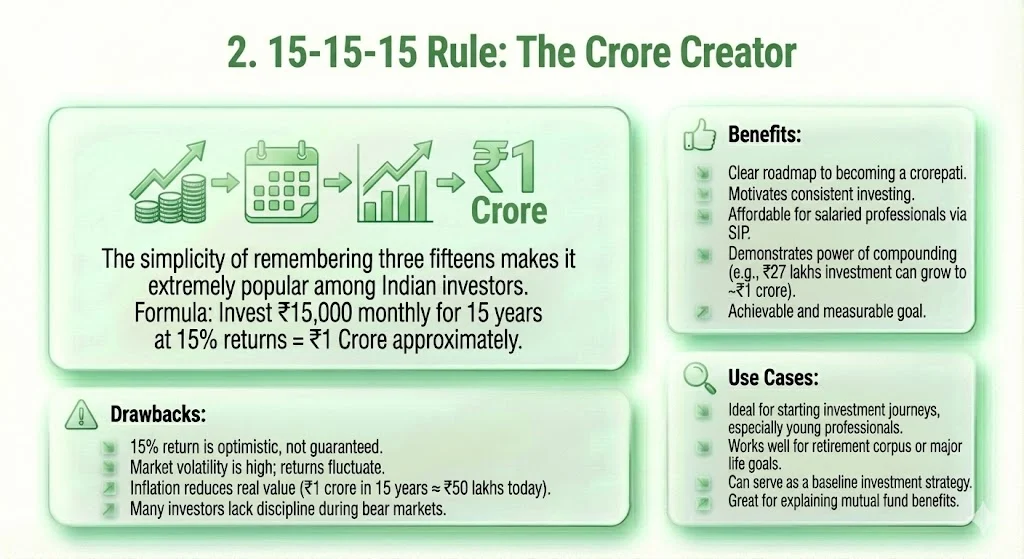

The 15-15-15 Rule became my favorite when I started my SIP journey five years ago. This rule states that investing ₹15000 per month for 15 years at 15% annual returns will build approximately ₹1 crore. The simplicity of remembering three fifteens makes it extremely popular among Indian investors.

Formula: Invest ₹15,000 monthly for 15 years at 15% returns = ₹1 Crore approximately

When I started my first SIP, I invested ₹15000 monthly in diversified equity mutual funds. After calculating using SIP calculators, I realized my total investment of ₹27 lakhs could potentially grow to over ₹1 crore if markets deliver 15% average returns. This visualization kept me motivated through market ups and downs.

Benefits Of 15 15 15 Rule

This rule provides a clear roadmap to becoming a crorepati which motivates consistent investing. The SIP route makes it affordable for salaried professionals like me. The power of compounding becomes crystal clear when you see how ₹27 lakhs input can generate ₹73 lakhs through growth alone. It is achievable and measurable unlike vague wealth creation advice.

Use Cases of Of 15 15 15 Rule

I recommend this rule to everyone starting their investment journey, especially young professionals. It works perfectly for retirement corpus building or major life goals. I personally use it as my baseline investment strategy and add more whenever I get bonuses or increments. It is also great for explaining mutual fund benefits to skeptical friends and family.

Drawbacks Of Of 15 15 15 Rule

The 15% return assumption is optimistic and not guaranteed. Indian equity markets have historically delivered 12 to 15% over long periods but with huge volatility. Some years you may lose 20% while others you may gain 30%. Inflation will reduce the real value of ₹1 crore in 15 years to perhaps ₹50 lakhs in today’s purchasing power. Many investors lack discipline to continue SIP during bear markets when panic sets in.

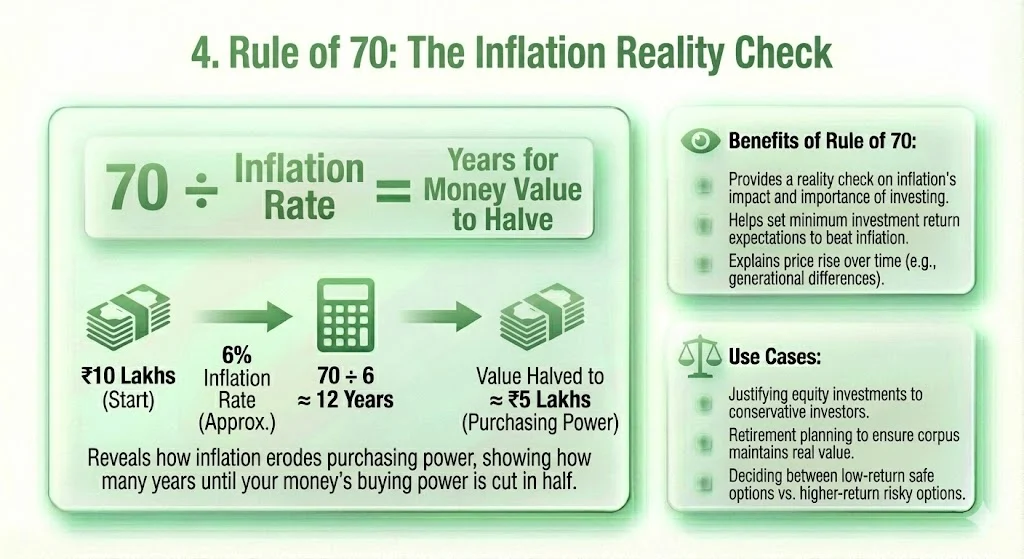

The Rule of 70 opened my eyes to the silent wealth killer called inflation. While other rules show growth, this one reveals how inflation erodes purchasing power. It calculates how many years until your money’s value gets cut in half due to rising prices.

Formula: 70 ÷ Inflation Rate = Years for Money Value to Halve

India’s average inflation hovers around 6% in recent years. When I divide 70 by 6, I get approximately 12 years. This shocked me initially because it means the ₹10 lakhs I have today will feel like only ₹5 lakhs in buying power just 12 years from now. This calculation convinced me that keeping money in savings accounts earning 3% is actually losing money after inflation.

Benefits Of Rule Of 70

This rule woke me up to the importance of investing rather than just saving. It provides a reality check on what returns I need to beat inflation. I now understand why my parents always complain that everything was so cheap in their time. It helps me set minimum return expectations for any investment I make.

Use Cases Of Rule of 70

I use this rule to justify equity investments to conservative investors who fear stock market volatility. It shows that safety of principal means nothing if inflation destroys purchasing power. I apply it when deciding between low return safe options versus higher return risky options. It also helps in retirement planning to ensure my corpus maintains real value.

Drawbacks Of Rule of 70

Inflation rates vary across product categories. Healthcare and education inflate faster than 6% while some goods inflate slower. The rule gives average impact but specific expenses may feel different. Also, government reported inflation often understates real price rise experienced by common people. The rule is more useful for long term perspective rather than precise calculations.

Also Read: Best Asset Allocation Rules That You Should Know

The 7-Year Rule saved me from a costly mistake early in my investment journey. This rule states never invest in stocks or volatile assets any money you will need within the next 7 years. I almost invested my house down payment in stocks but this rule made me reconsider.

Formula: Don’t invest money needed within 7 years in volatile assets

When I was accumulating down payment for my flat purchase planned in 3 years, I kept that money in debt mutual funds and bank FDs rather than equity. Although stocks seemed tempting during a bull run, the 7-Year Rule protected me from potential losses if markets crashed before my purchase timeline.

Benefits Of 7 Year Rule

This rule provides a clear risk boundary for investment decisions. It prevents emotional mistakes during bull markets when everyone seems to be making quick money in stocks.

I sleep peacefully knowing my emergency fund and short term goal money is safe from market volatility. It matches investment choice with goal timeline which is fundamental to smart investing.

Use Cases Of 7 Year Rule

I apply this rule for all goal based investments. Emergency fund, children’s school fees, upcoming wedding expenses all follow this rule and stay out of equities.

Only my retirement fund and long term wealth creation money goes into stocks because I have 20 plus years for those goals. It helps me create proper asset allocation across different buckets.

Drawbacks Of 7 Year Rule

Following this rule strictly means missing out on potential stock market gains for short term money. If I had invested my house down payment in stocks five years ago and markets went up, I would have made more money.

The opportunity cost can be significant during prolonged bull markets. Also, determining exactly when you will need the money is not always possible due to life uncertainties.

Also Read: Best Budgeting and Saving Rules That You Should Know

Tags: investment rules, rule of 72, mutual fund investing, SIP investment strategy, compounding returns, wealth creation, financial planning

Share This Post