BCCL IPO GMP Today: Bharat Coking Coal IPO Latest News, Price, Subscription and Listing Outlook

The Bharat Coking Coal Limited IPO has become the most discussed stock market event of January 2026. As the first mainboard IPO of the year, it has drawn heavy attention from retail investors, non institutional buyers and Coal India shareholders who are tracking the GMP of Bharat Coking Coal every day.

The issue opened on January 9 and will close on January 13. In the grey market, the BCCL IPO GMP today is showing strong interest even after some cooling from the early hype. With solid subscription data and steady demand, the Bharat Coal IPO has become one of the most followed listings of this month.

Also Read: Vijay Kedia Takes Fresh Stake In Beaten Down Mangalam Drugs Stock

Bharat Coking Coal Limited is coming to the stock market with a total issue size of Rs 1,071 crore. This IPO is a full Offer for Sale by Coal India Limited, which means no fresh money will come into the company. Coal India is reducing part of its stake through this public issue.

The price band is fixed at Rs 21 to Rs 23 per share. Investors have to apply for a minimum of 600 shares, which means the minimum investment at the upper band is around Rs 13,800. The basis of allotment is expected on January 14, and the shares are likely to list on January 16 on both NSE and BSE.

The grey market premium of Bharat Coking Coal has remained active since the IPO was announced. In early January, the GMP was close to Rs 16, which suggested over 70 percent listing gains. As the issue opened, the premium corrected and stabilised.

As of January 10, 2026, the BCCL IPO GMP today is in the range of Rs 9 to Rs 10. Some market trackers are also quoting a slightly higher band near Rs 10 to Rs 11 in intraday trades. Based on the upper price of Rs 23, this suggests a likely listing price between Rs 32 and Rs 33. This indicates a possible gain of around 40 to 43 percent on listing day.

Investors are tracking the GMP of Bharat Coking Coal closely as it reflects short term sentiment. Even though GMP is not official, it gives a fair idea of how traders are valuing the IPO.

The Bharat Coking Coal IPO saw a very strong response on Day 1. The issue was fully subscribed within minutes after opening and demand kept rising through the day.

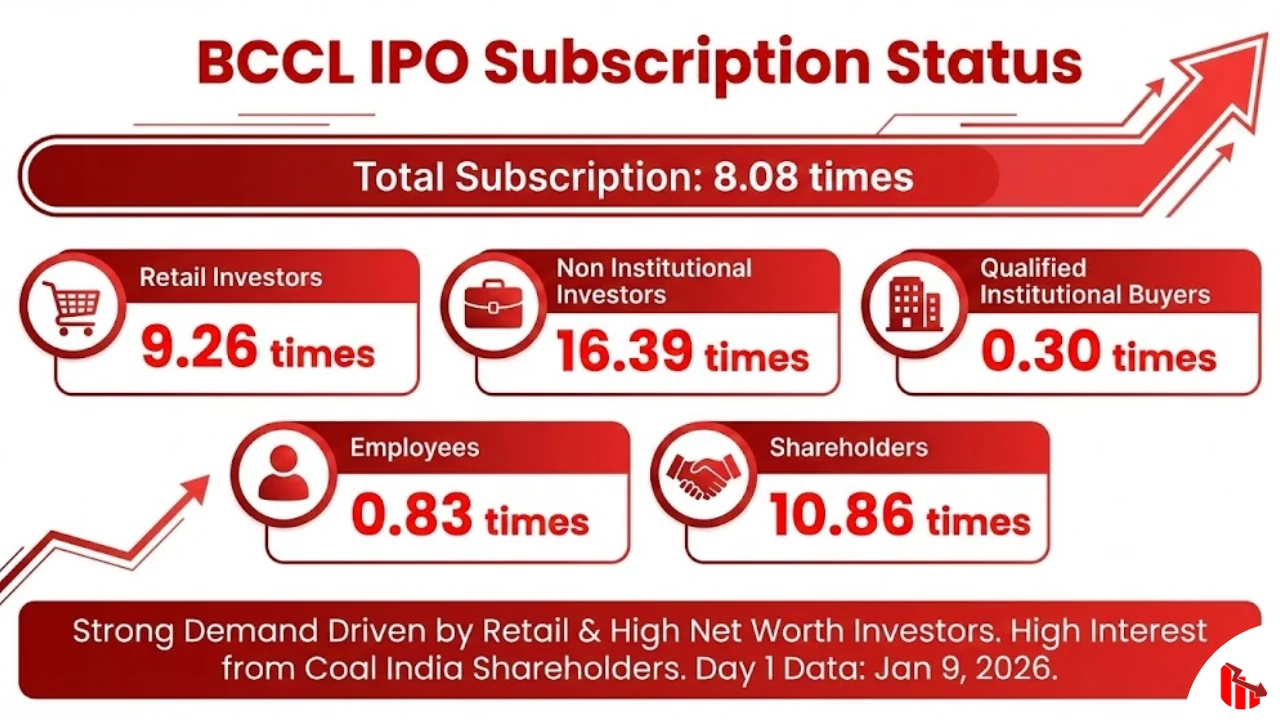

Below is the Day 1 subscription data from January 9, 2026.

| Category | Subscription |

|---|---|

| Total | 8.08 times |

| Retail Investors | 9.26 times |

| Non Institutional Investors | 16.39 times |

| Qualified Institutional Buyers | 0.30 times |

| Employees | 0.83 times |

| Shareholders | 10.86 times |

The data shows that retail and high net worth investors are driving the demand. The shareholder quota also saw strong interest from Coal India investors who were eligible to apply.

Bharat Coking Coal Limited is a wholly owned subsidiary of Coal India Limited. It is India’s largest producer of coking coal, which is a critical raw material for steel manufacturing. In FY25, the company produced about 58.5 percent of the country’s domestic coking coal.

The company operates 34 mines across Jharkhand and West Bengal. These include underground mines, opencast mines and mixed operations. Its total leasehold area is about 288 square kilometres. BCCL also runs multiple coal washeries which are used to clean coal and improve its quality before supplying to steel companies.

The company holds estimated coking coal reserves of around 7.91 billion tonnes, making it the most important domestic source of this fuel. This gives BCCL a strong position in India’s steel supply chain.

Bharat Coking Coal has shown steady growth in production over the last few years. Output increased from about 30 million tonnes in FY22 to around 40 million tonnes in FY25. This shows the company has been able to scale up its mining operations.

Revenue from operations in FY25 was Rs 13,803 crore. Profit after tax for the same year was Rs 1,240 crore. In the first half of FY26, profits dropped sharply to Rs 123.88 crore, mainly due to lower production, higher costs and slower cash collection from customers.

The company also saw an increase in trade receivables which crossed Rs 2,200 crore by September 2025. This means customers are taking longer to pay, which can put pressure on cash flows.

One of the biggest strengths of BCCL is its dominant market share. With nearly 58.5 percent of domestic coking coal production, it enjoys a near monopoly in India. This gives it pricing power and stable demand from steel companies.

Another key strength is its reserve base. With over 7.9 billion tonnes of coking coal reserves, BCCL has long term visibility for supply. This supports future operations and reduces dependence on imports.

The backing of Coal India is also a major advantage. Coal India is the largest coal producer in the world and provides technical, financial and operational support to BCCL.

The biggest concern is the recent fall in profits. The sharp drop in earnings in the latest half year shows how sensitive the business is to costs, weather and operational delays.

The company has also taken new borrowings of about Rs 1,559 crore, after being debt free in earlier years. Rising debt and slow collections from customers can affect future cash flow.

There are also sector risks. Coal is a cyclical industry and faces long term pressure from clean energy goals and environmental regulations.

For many investors, the main attraction in the Bharat Coal IPO is the potential listing gain. With the GMP of Bharat Coking Coal limited IPO showing around 40 percent premium, traders expect a strong debut.

However, GMP can change fast. It depends on market conditions and overall investor mood. Those applying only for short term gains should keep watching the GMP trend until listing day.

Long term investors should focus more on the company’s financial performance, cash flow and how it manages its debt and receivables after listing.

The BCCL IPO has created strong buzz in the market. With heavy subscription, solid grey market premium and the backing of Coal India, Bharat Coking Coal has become one of the most watched listings of early 2026.

The current GMP of Bharat Coking Coal suggests a healthy listing premium, though it has cooled from earlier highs. Investors looking for listing gains may find interest in this IPO, while long term holders should keep an eye on profit recovery and cash flow trends in the coming quarters.

Tags: bccl ipo, bharat coking coal, bccl gmp, coal india ipo, indian ipo news, grey market premium

Share This Post