TCS Q3 Results FY26

Tata Consultancy Services released its Q3 FY26 results on January 12, 2026. The numbers show a mix of pressure on profits and steady progress in core business. Revenue stayed firm while profit took a hit due to one time charges. At the same time the company reported strong AI growth and healthy deal wins.

The market reaction was divided. Headlines focused on the profit fall. Long term investors looked at AI revenue, contract pipeline and dividend. This created a situation where the numbers looked weak on the surface but the base business stayed stable.

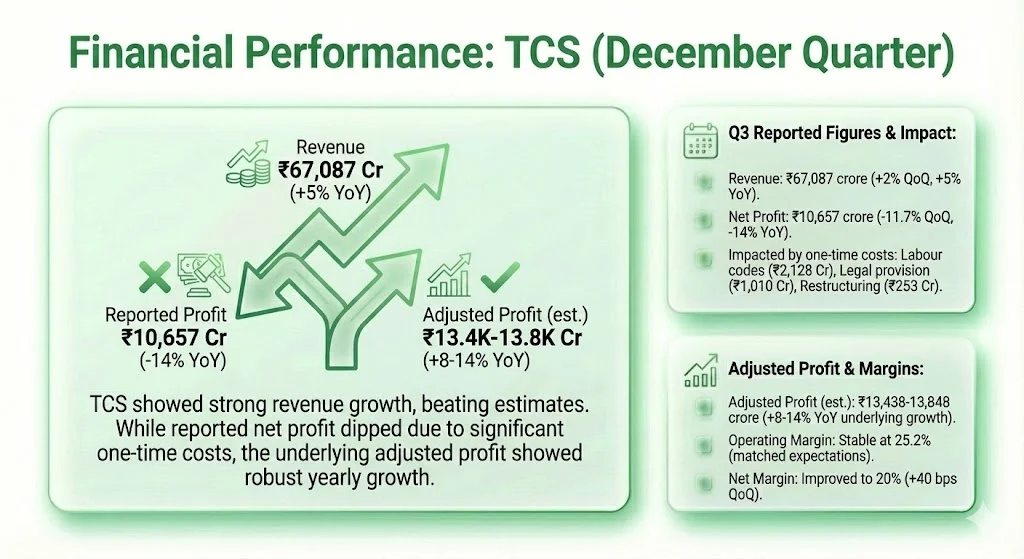

TCS reported revenue of ₹67,087 crore in the third quarter. This was a 2 percent rise over the previous quarter and close to 5 percent higher than last year. The number came above most market estimates which were near ₹66,800 crore.

Net profit for the quarter was ₹10,657 crore. This was lower by 11.7 percent compared to Q2 and around 14 percent lower than last year. The drop in profit was mainly due to one time costs linked to new labour laws and legal provisions.

The company took a charge of about ₹2,128 crore related to changes in Indian labour codes. It also made a provision of ₹1,010 crore for a legal claim. Restructuring costs of about ₹253 crore were also booked during the quarter.

When these one time items are removed, the adjusted profit was much higher. Based on various estimates it was in the range of ₹13,438 crore to ₹13,848 crore. This means underlying profit actually showed growth of around 8 to 14 percent on a yearly basis.

Operating margin for the quarter was stable at 25.2 percent. This matched street expectations. Net margin improved to 20 percent which was up by 40 basis points from the previous quarter.

Also Read: Best Investment Growth And Timeline Rules That You Should Know

| Metric | Q3 FY26 |

|---|---|

| Revenue | ₹67,087 crore |

| QoQ revenue growth | 2 percent |

| YoY revenue growth | about 5 percent |

| Net profit | ₹10,657 crore |

| QoQ profit change | minus 11.7 percent |

| YoY profit change | minus 14 percent |

| Operating margin | 25.2 percent |

| Net margin | 20 percent |

| Total contract value | $9.3 billion |

| AI annualised revenue | $1.8 billion |

| Headcount | 582,163 |

| Dividend | ₹57 per share |

The main reason for the profit decline was not weak business demand. It was the impact of one time charges. The new labour code rules forced the company to recognise higher employee related costs. This alone was over ₹2,000 crore.

On top of this TCS booked a legal provision of ₹1,010 crore. It also spent on restructuring as part of its ongoing optimisation plan. These costs reduced reported profit sharply for the quarter.

The company and many analysts have pointed out that these are not regular expenses. Once these charges are excluded the core profit trend looks healthy. This is why many investors are focusing more on adjusted numbers than the headline profit.

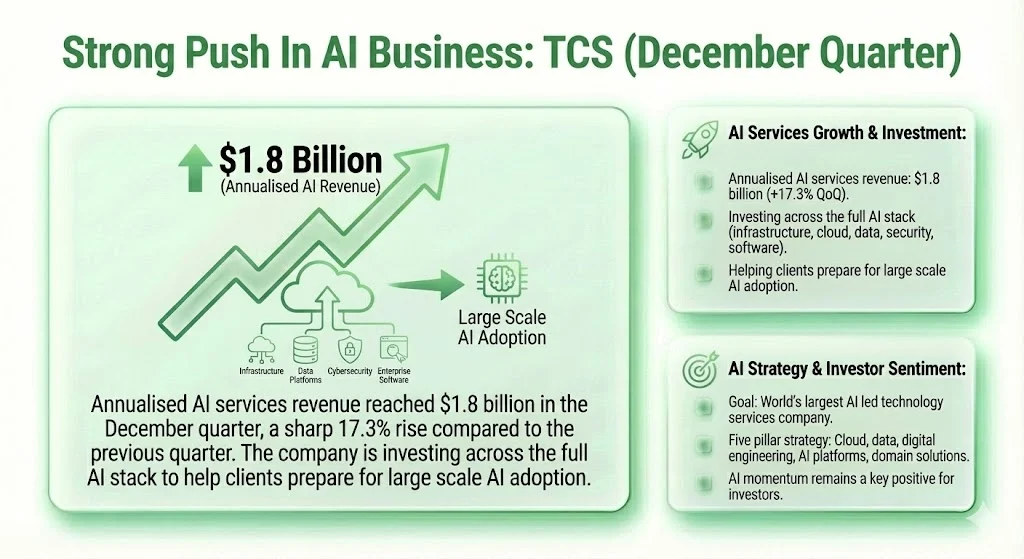

One of the most important parts of the Q3 results was the growth in AI related services. TCS said its annualised AI services revenue reached $1.8 billion in the December quarter. This was a sharp 17.3 percent rise compared to the previous quarter.

The company is investing across the full AI stack. This includes infrastructure, cloud, data platforms, cybersecurity and enterprise software. Clients are using these services to prepare their systems for large scale AI adoption.

The management has repeated its goal of becoming the world’s largest AI led technology services company. It follows a five pillar strategy that covers cloud, data, digital engineering, AI platforms and domain solutions.

This AI momentum is one of the main reasons many investors remain positive about TCS even after the profit miss.

Growth was mixed across regions and business segments.

In North America revenue grew 0.1 percent on a quarter basis and 1.3 percent year on year. The UK saw a 1.9 percent fall from Q2 and a 3.2 percent fall on a yearly basis. Europe grew 2.1 percent quarter on quarter and 1.4 percent year on year.

India recorded strong quarter on quarter growth of 8 percent. But on a yearly basis it was down 34.3 percent. This reflects the lumpy nature of large government and enterprise projects.

Latin America grew 4.6 percent sequentially and about 1.4 percent year on year. The Middle East and Africa region posted 8.3 percent growth year on year. Asia Pacific grew 3.5 percent.

By business segment BFSI which is the largest vertical for TCS grew 1.6 percent year on year. It slipped 0.4 percent from Q2. Consumer business declined 2.7 percent year on year but grew 1.3 percent sequentially. Life sciences and healthcare grew 2.2 percent year on year and 0.9 percent from Q2.

Energy, resources and utilities also grew around 2.2 percent year on year.

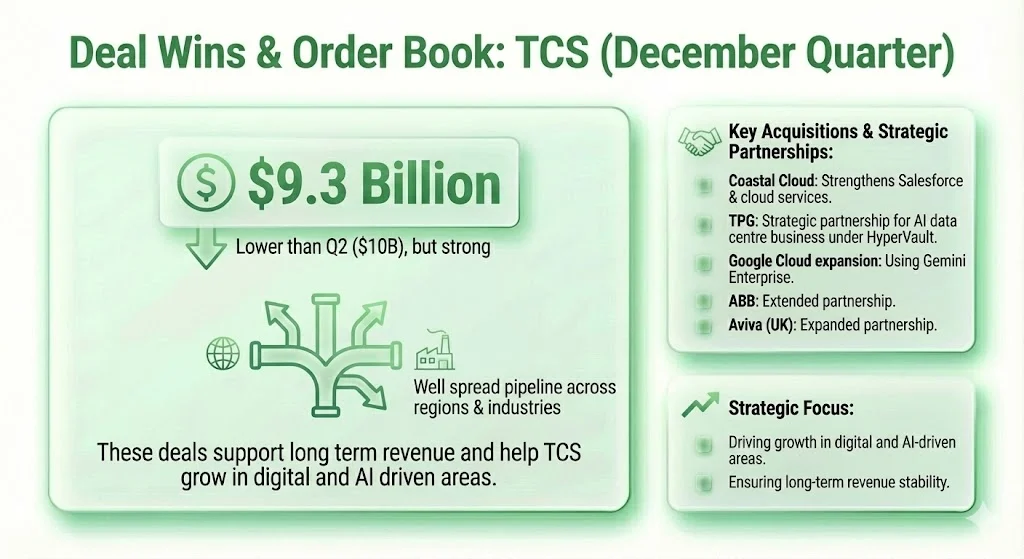

Total contract value for the quarter was $9.3 billion. This was lower than Q2 which had $10 billion but still strong in absolute terms. It also showed a well spread pipeline across regions and industries.

Some key deals and partnerships announced during the quarter included

These deals support long term revenue and help TCS grow in digital and AI driven areas.

TCS continued to optimise its workforce. Total headcount declined by about 11,151 during the quarter to 582,163. Voluntary attrition for IT services stood at 13.5 percent.

At the same time the company focused on building next generation skills. Over 217,000 employees now have advanced AI skills. TCS also doubled the intake of fresh graduates with higher order skills to support future projects.

The management believes this mix of optimisation and reskilling will help maintain margins while preparing the company for AI led demand.

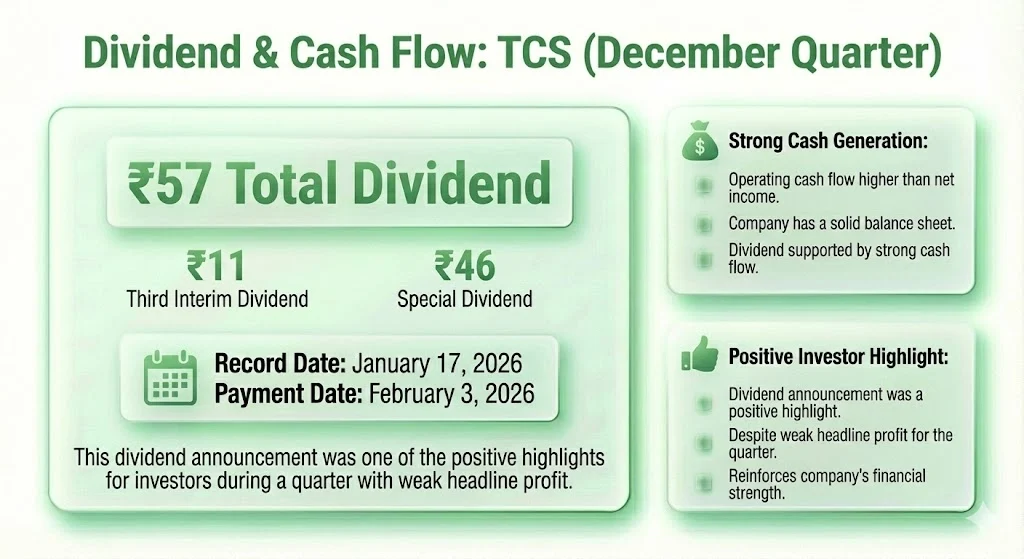

TCS declared a third interim dividend of ₹11 per share and a special dividend of ₹46 per share. This takes the total payout to ₹57 per share for the quarter.

The record date is January 17, 2026. The payment date is February 3, 2026.

The dividend was supported by strong cash generation. Operating cash flow remained higher than net income which shows the company has a solid balance sheet.

This dividend announcement was one of the positive highlights for investors during a quarter with weak headline profit.

Public discussion on social media and market forums has been mixed but not overly negative. Many users are pointing out that the profit drop is mainly due to one time costs.

There is strong focus on the $1.8 billion AI revenue and the $9.3 billion order book. Several investors believe this shows good future growth visibility.

Some traders and short term investors were disappointed by the profit miss and the fall in headcount. Others see the stock as a long term value play given its strong cash flow and dividend.

There is also a wider view that the IT sector is going through a soft phase as global clients remain cautious. In this context TCS holding margins and winning deals is seen as a positive sign.

The key factors to watch for TCS will be how fast AI services convert into large revenue streams. The company is clearly placing big bets in this area. Its training programs and acquisitions show a long term strategy.

Deal wins will also remain important. A steady order book above $9 billion each quarter can support growth even if some regions remain slow.

Margins are expected to stay in the mid 20 percent range as TCS continues cost control and automation. Headcount may remain under pressure as the company focuses on efficiency.

Overall the Q3 FY26 results reflect a company in transition. Short term profit was hurt by accounting and regulatory changes. Core business trends remain steady with strong digital and AI demand.

Tags: TCS Q3 results, Tata Consultancy Services, TCS earnings FY26, IT sector India, TCS dividend, AI services

Share This Post