Why Market Is Down Today: Trade War Fears Trigger Sell Off

The stock market witnessed a sharp and sudden fall on January 20, with pressure continuing in discussions on January 21. Equity markets across the globe moved lower in a single session that erased recent gains and pushed investors into a risk-off mode.

The decline was not limited to one region or sector. Selling was broad based, driven mainly by geopolitical headlines, trade related fears, and nervous global cues. Indian markets followed the global trend, reacting to weak sentiment and sustained foreign selling.

Also Read: Gold Price Today: Gold Crosses ₹1.55 Lakh – Break All Records

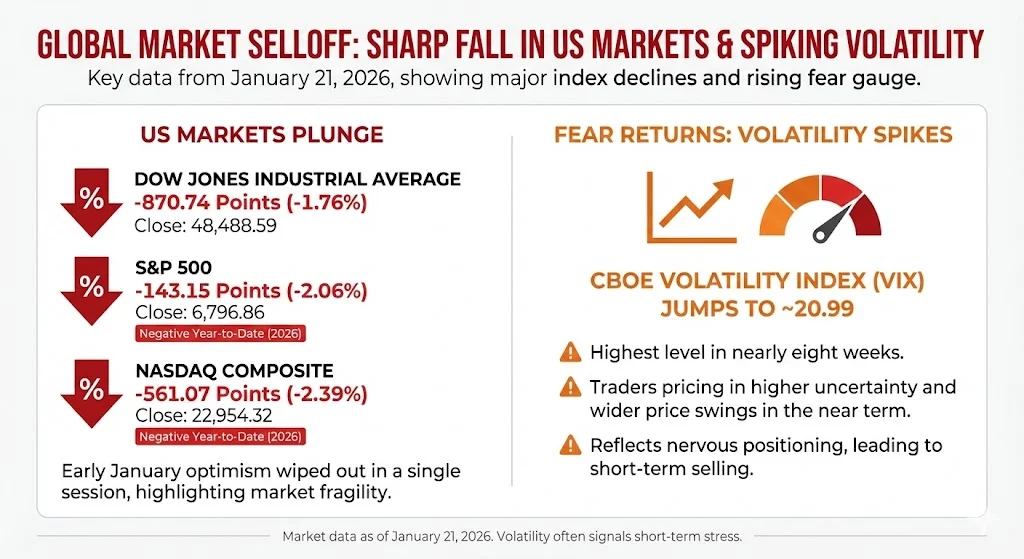

The immediate trigger for the market fall came from the United States. On January 20, major US indices recorded their worst session in months. The Dow Jones Industrial Average dropped nearly 1.8 percent, losing close to 800 to 870 points and ending near the 48,488 level.

The S&P 500 declined around 2.06 percent or roughly 143 points, closing close to the 6,800 mark. This fall wiped out all gains made so far in 2026 and pushed the index into negative territory for the year. The Nasdaq Composite faced the maximum pressure, sliding 2.39 percent or more than 560 points as technology stocks came under heavy selling.

In just one session, the US stock market lost between $1 trillion and $1.4 trillion in total value. Selling was seen across sectors, with technology and consumer discretionary stocks leading losses. Consumer staples showed mild resilience but could not offset broader weakness.

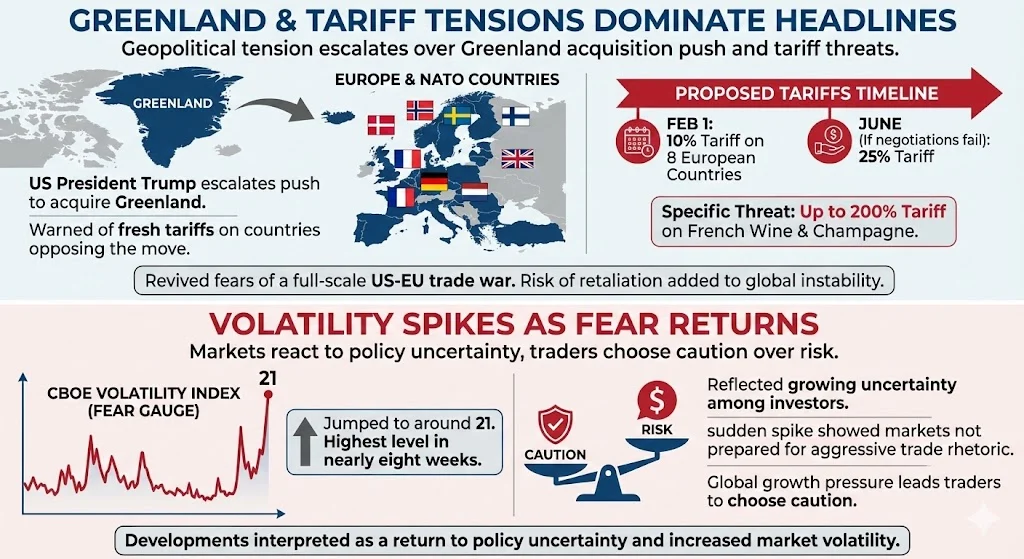

The main reason behind the sharp fall was renewed geopolitical tension linked to Greenland. Over the weekend and into Tuesday, US President Donald Trump escalated his push to acquire Greenland. He warned of fresh tariffs on European and NATO countries that oppose the move.

According to market reports, Trump proposed a 10 percent tariff on imports from eight European countries starting February 1. These tariffs could rise to 25 percent by June if negotiations fail. The countries mentioned include Denmark, Norway, Sweden, France, Germany, the Netherlands, Finland, and the UK.

He also spoke about imposing tariffs as high as 200 percent on French wine and champagne as part of related disputes. These statements revived fears of a full scale US EU trade war. Investors recalled earlier phases of tariff driven volatility and reacted by reducing exposure to equities.

Markets interpreted these developments as a return to policy uncertainty. The risk of retaliation from Europe, involving billions in countermeasures, added to global instability concerns.

As markets reacted to the news, volatility surged. The CBOE Volatility Index, often called the fear gauge, jumped to around 21. This marked its highest level in nearly eight weeks and reflected growing uncertainty among investors.

The sudden spike showed that markets were not prepared for aggressive trade rhetoric at this stage of the economic cycle. With global growth already facing pressure, traders chose caution over risk.

Indian equity markets extended losses in line with weak global signals. On January 20, benchmark indices slipped to their lowest levels in over three months. The Nifty fell below the 25,300 mark during the session, while the Sensex dropped to levels last seen in October 2025.

The Nifty ended the day lower by around 1.38 percent, while the Sensex closed down nearly 1.28 percent. Since hitting lifetime highs in early January, the Nifty has declined about 4 percent, and the Sensex has lost over 3,700 points.

Market breadth remained weak throughout the session. On the BSE, declining stocks far outnumbered advancing ones, showing that selling pressure was spread across the market and not limited to index heavyweights.

Almost all major sectors ended the session in the red. Realty stocks faced the steepest fall, losing over 4 percent during the day. Consumer durables and capital goods stocks also saw notable selling.

Technology shares continued to act as a drag on the indices. Weak early earnings signals and concerns over global demand weighed on export focused IT companies. Investors remained cautious ahead of more quarterly results.

The earnings season has so far failed to excite the market. Early results for the October to December quarter showed only modest growth in revenues and profits. Combined net profits of early reporting companies stood near ₹98,621 crore, only slightly higher than the previous year and lower than the preceding quarter.

Foreign portfolio investors remained net sellers, adding to the pressure on Indian equities. FPIs have sold over ₹27,000 crore worth of shares so far this month. This follows heavy selling seen in late 2025 as well.

Persistent outflows reflect global risk aversion and concerns over trade tensions. While domestic institutional investors provided some support through selective buying, it was not enough to counter foreign selling.

With uncertainty rising, investors are largely in a wait and watch mode and are avoiding fresh positions.

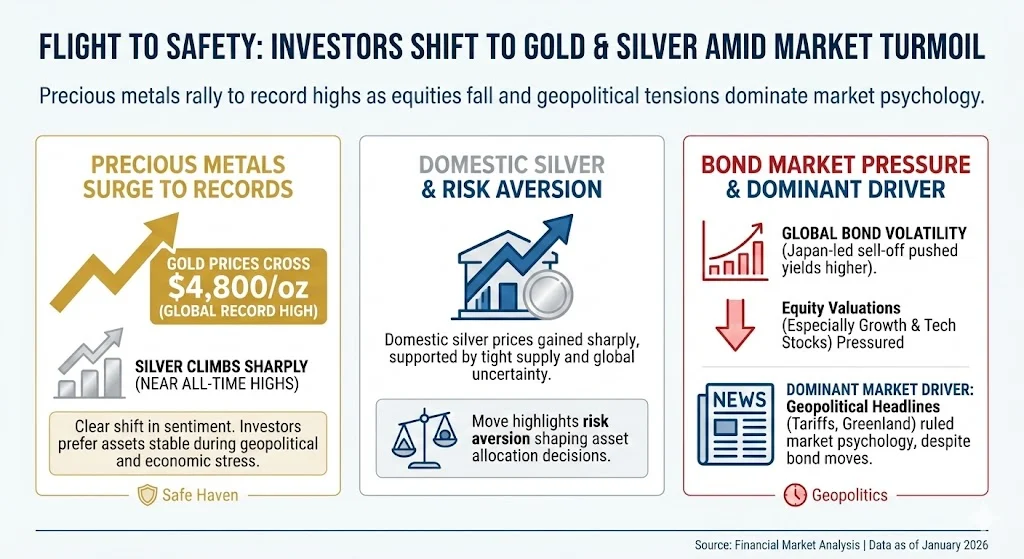

As equities fell, investors moved quickly toward safe haven assets. Gold prices surged to record highs, crossing the $4,800 per ounce mark in global markets. Silver also climbed sharply and remained near all time highs.

This strong rally in precious metals reflects a clear shift in sentiment. Investors prefer assets perceived as stable during periods of geopolitical and economic stress. The surge in gold and silver prices became one of the most discussed themes across markets.

In domestic markets, silver prices gained sharply in recent sessions, supported by tight supply conditions and global uncertainty. The move highlights how risk aversion is shaping asset allocation decisions.

Alongside equity selling, global bond markets also saw volatility. A Japan led bond sell off pushed yields higher in several regions. Rising yields added pressure on equity valuations, especially in growth and technology stocks.

Although bond market movements played a role, most traders and analysts agree that geopolitical headlines linked to tariffs and Greenland dominated market psychology.

Public reaction on social media reflected fear, confusion, and frustration. Many users questioned the sudden fall and linked it to broader economic issues. Some pointed to weakness in currencies and rising taxation concerns, especially in India.

Traders spoke about panic selling and also highlighted short term opportunities. A few posts focused on crypto markets, noting that Bitcoin and digital assets were also affected by the risk off mood.

Gold received widespread admiration, with many users calling it the true hedge during times of crisis. There were also voices suggesting that markets were reacting too strongly to headlines rather than fundamentals.

Overall sentiment remained bearish, with caution dominating discussions.

Markets are likely to remain volatile in the near term. Developments related to US EU trade talks and any signs of de escalation will be closely tracked. Global bond yields, currency movements, and upcoming earnings reports will also influence sentiment.

For Indian markets, the focus will remain on foreign investor flows, earnings momentum, and global cues. Until clarity emerges, sharp swings cannot be ruled out.

Investors may prefer a cautious approach and avoid aggressive positioning during periods of heightened uncertainty.

Tags: stock market today, why market is down, global market crash, trade war impact, stock market news, market volatility

Share This Post