Kalyan Jewellers Stock Down Reason: 25% Fall in 9 Days - Hits 52W Low

Shares of Kalyan Jewellers India Ltd witnessed a sharp sell off in recent trading sessions. The stock touched a fresh 52 week low as heavy selling pressure continued across consecutive days. Market participants turned cautious as the price structure weakened and volumes expanded on the downside.

As of January 21, 2026, Kalyan Jewellers closed around ₹396 to ₹397 after falling nearly 12 percent in a single session. During the day, the stock slipped as much as 14 percent to ₹389.10. This marked the ninth straight session of losses and extended the recent correction seen in the stock.

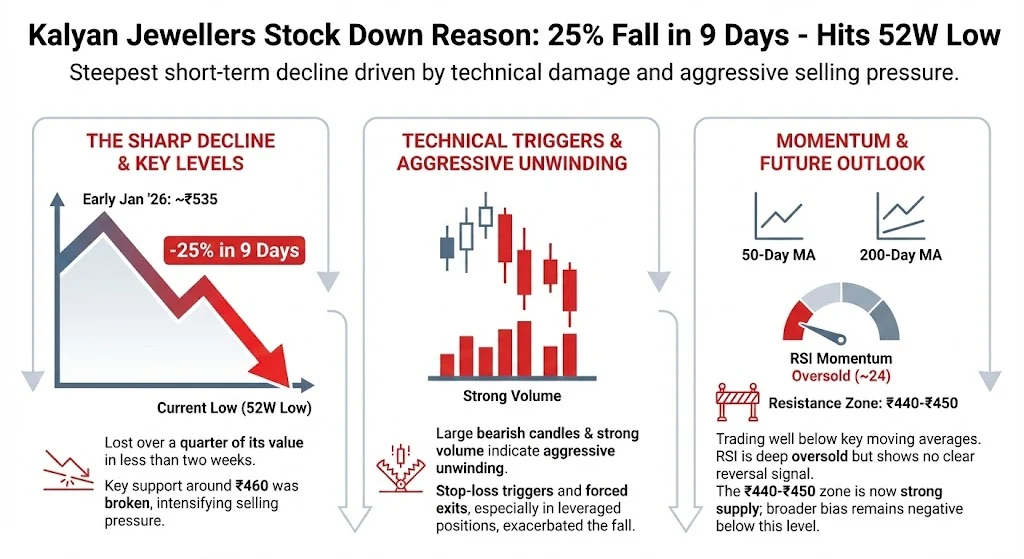

Kalyan Jewellers has seen one of its steepest short term declines in recent years. The stock was trading near ₹535 in early January 2026. In less than two weeks, it lost more than a quarter of its value. Such sharp falls often point to a mix of technical damage and sentiment driven selling.

The daily charts show large bearish candles forming with strong volume. This indicates aggressive unwinding of positions rather than routine profit booking. Traders also reported stop loss triggers and forced exits, especially in leveraged positions.

Also Read: Gold Price Today: Gold Crosses ₹1.55 Lakh – Break All Records

One of the main reasons behind the fall is sustained technical weakness. The stock broke below important support zones around ₹460. Once this level failed, selling pressure intensified rapidly.

Currently, the stock is trading well below its 50 day and 200 day moving averages. Momentum indicators also show stress. The Relative Strength Index dropped to around 24, placing the stock deep in the oversold zone. Despite this, no clear reversal signal has appeared yet.

Analysts tracking the charts note that the price structure remains weak below the ₹440 to ₹450 zone. This area has now turned into a strong supply region. As long as the stock stays below this range, the broader bias remains negative.

Institutional activity has also played a role in the decline. Recent shareholding data points to churn among large holders. Some mutual funds reduced exposure during the recent period, which added to the supply in the market.

For example, Motilal Oswal Midcap Fund trimmed its stake meaningfully. Sundaram Midcap Fund, which earlier appeared in the shareholder list, no longer figures among the top holders. Such changes are closely watched by the market and often influence short term sentiment.

Low retail holding, estimated near 6 percent, has also made the stock more sensitive to institutional flows. When large players reduce exposure, price moves tend to be sharper.

Another factor weighing on sentiment is the rise in promoter pledging. The percentage of promoter shares pledged increased to around 24.89 to 25 percent. This is higher compared to nearly 19 percent a year earlier.

While pledging does not always indicate stress, rising pledged shares during a falling market tend to worry investors. It raises questions around leverage and risk management, especially during volatile phases.

| Period | Pledged Shares |

|---|---|

| December 2024 | 19.32% |

| December 2025 | 24.89% |

| Change | +5.57% |

The jewellery sector is also facing headwinds from volatile gold prices. Gold has been trading at elevated levels, which impacts affordability for consumers. Higher prices can delay purchases or reduce volumes, especially in discretionary categories.

Although there is no direct evidence of demand collapse, cautious spending and broader market weakness have affected sentiment around jewellery stocks. Investors tend to reduce exposure to gold linked businesses during uncertain phases.

Kalyan Jewellers delivered strong returns in the past. Since listing, the stock gained over 400 percent at its peak. Even before the recent fall, valuations had expanded significantly compared to historical averages.

As the broader midcap space came under pressure, stocks with higher valuations saw sharper corrections. Profit booking by long term holders added to the downward momentum. Some brokerages also turned cautious due to technical damage and near term valuation risks.

Intraday data from January 21, 2026, showed multiple large trades within a short time window. Several blocks amounting to over 8 lakh shares were executed around prices of ₹406 to ₹407. The cumulative value of these trades was close to ₹39 crore.

Such activity during a falling market often signals institutional selling or portfolio rebalancing. While the identity of buyers and sellers is not known, these transactions added to the pressure during the session.

Despite the sharp fall, there has been no major negative update on the business side. Brokerages continue to highlight stable fundamentals and growth visibility.

Earlier quarterly updates pointed to strong festive demand and expansion plans. Consolidated sales growth of nearly 42 percent year on year was reported in previous updates. Store additions also continued across India and overseas markets.

| Metric | Q2 FY25 | Q2 FY26 |

|---|---|---|

| Revenue | ₹6,065 crore | ₹7,856 crore |

| Net Profit | ₹130 crore | ₹261 crore |

The company is scheduled to announce its December quarter results on February 6, 2026. Market participants are closely watching this event for clarity on margins, demand trends, and management commentary.

Some analysts believe earnings could act as a short term trigger. However, until the technical structure improves, sentiment is expected to remain cautious.

Recent posts on X reflect frustration among traders and investors. Many highlighted heavy losses in leveraged positions and warned against averaging without confirmation. Comments around panic selling, short build up, and institutional dominance were common.

While a few see the stock as oversold and capable of a bounce if supports hold, the majority view remains defensive in the near term. Phrases like wait for reversal and avoid for now dominate current discussions.

The fall in Kalyan Jewellers stock appears to be driven largely by technical breakdown and sentiment pressure rather than a fundamental collapse. Institutional churn, rising promoter pledge, and gold price volatility amplified the move. With the stock trading near key support levels, investors are waiting for clearer signals before taking fresh positions.

Short term direction is likely to remain volatile until price structure improves and earnings provide further clarity.

Tags: Kalyan Jewellers, Kalyan Jewellers stock, jewellery stocks India, midcap stocks, stock market news

Share This Post