Planning for retirement can feel overwhelming but I have seen how simple rules can transform financial security. Best Retirement And Withdrawal Rules In India provide tested frameworks for withdrawing your retirement corpus without running out of money. These rules help you balance regular income needs with the safety of your savings throughout retirement years.

India’s retirement landscape has evolved dramatically in 2025 with new NPS reforms and rising life expectancy. I understand that creating a sustainable withdrawal strategy is no longer optional but essential for peaceful golden years. The average Indian now lives beyond 70 years and medical inflation runs at 10% annually making these rules more relevant than ever.

Whether you are planning early retirement through FIRE or approaching traditional retirement age these withdrawal strategies offer proven paths. I will walk you through six essential rules that can secure your financial future while maintaining your desired lifestyle.

Also Read: Best Investment Growth And Timeline Rules That You Should Know

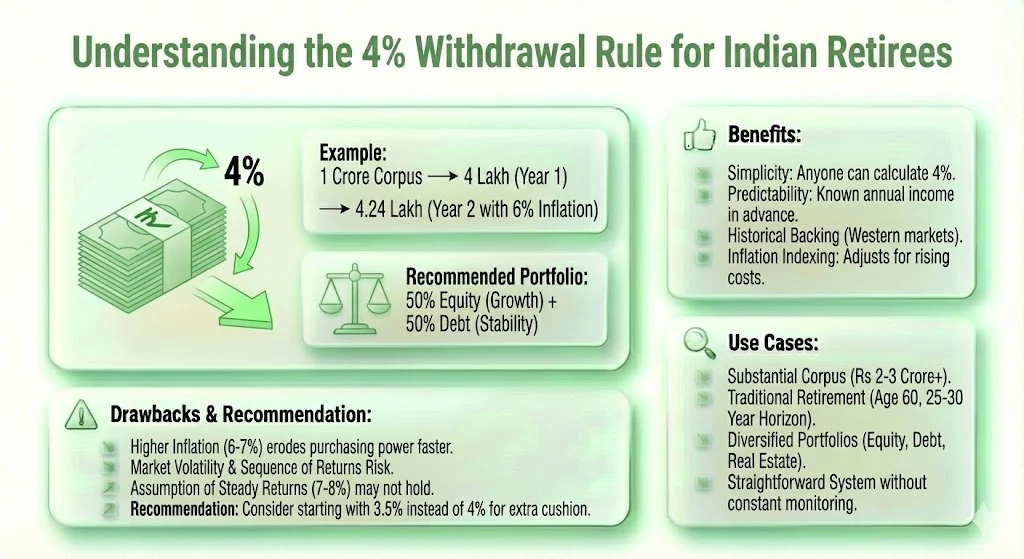

The 4% withdrawal rule remains one of the most discussed retirement strategies globally. I have researched this extensively and found it requires careful adaptation for Indian conditions. This rule suggests you withdraw 4% of your total retirement savings in the first year and then adjust that amount annually for inflation.

Let me explain with a real example. If I have accumulated Rs 1 crore for retirement then I would withdraw Rs 4 lakh in the first year. Next year with 6% inflation I would withdraw Rs 4.24 lakh and so on. The original research by William Bengen assumed US market conditions with 2-3% inflation but India faces 6-7% average inflation which changes everything.

The rule assumes your investments earn returns that match or exceed your withdrawal rate plus inflation. I typically recommend a balanced portfolio with 50% equity and 50% debt for this strategy. The equity portion provides growth while debt offers stability during market downturns.

I have observed several advantages when clients implement this strategy correctly. The simplicity stands out immediately because anyone can calculate 4% without complex formulas. My experience shows retirees appreciate the predictability of knowing their annual income well in advance.

The historical backing provides confidence as decades of data support its effectiveness in Western markets. I also value how this rule automatically adjusts for rising costs through inflation indexing. Your purchasing power remains relatively stable throughout retirement which reduces financial anxiety significantly.

This rule works best for specific situations I encounter regularly. If you have built a substantial corpus of Rs 2-3 crore or more the 4% rule provides comfortable annual income. I recommend it for those retiring at traditional age 60 with a 25-30 year planning horizon.

My clients with diversified portfolios mixing equity mutual funds debt instruments and some real estate find this approach effective. The rule also suits individuals who want a straightforward system without constant monitoring or adjustments.

However I must highlight important limitations based on my observations. India’s higher inflation rate of 6-7% erodes purchasing power faster than the rule accounts for. I have seen market volatility hit harder here than in developed markets especially during early retirement years.

The assumption of steady 7-8% returns does not always hold true particularly when rupee depreciation affects imported goods costs. I also notice many retirees face unexpected medical expenses that the basic 4% framework cannot accommodate. Starting withdrawals during a market crash can deplete your corpus much faster than planned.

My recommendation: Consider starting with 3.5% instead of 4% to build extra cushion against Indian market conditions.

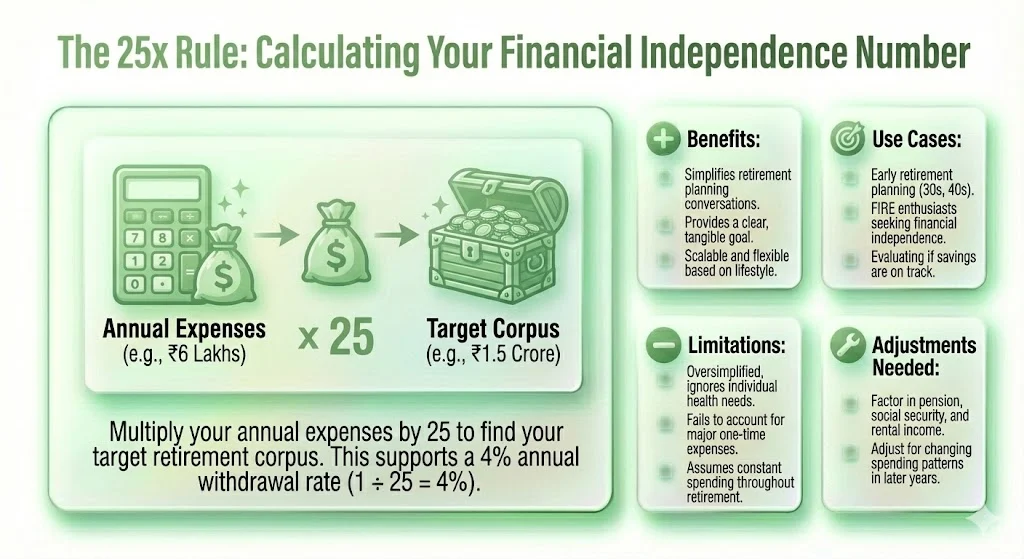

The 25x rule provides my favourite quick method for retirement corpus calculation. I use this constantly when helping people understand their retirement needs. Simply multiply your annual expenses by 25 and that gives your target retirement corpus.

Here is how I apply it practically. If your annual household expenses total Rs 6 lakh then multiply by 25 to get Rs 1.5 crore as your retirement target. This number represents the amount you need to withdraw 4% annually which circles back to the previous rule.

The 25x multiplier connects directly to the 4% withdrawal rate because 1 divided by 25 equals 4%. I find this inverse relationship elegant and easy to remember. Your corpus generates income while the principal ideally remains intact or grows moderately.

I appreciate how the 25x rule simplifies retirement planning conversations. My clients grasp this concept within minutes unlike complex financial projections. The rule provides a clear tangible goal that motivates consistent saving and investment.

The flexibility also impresses me because you can adjust based on lifestyle choices. I have worked with minimalist clients targeting 20x and others seeking 30x for more comfortable margins. The rule scales beautifully whether your annual expenses are Rs 3 lakh or Rs 15 lakh.

I recommend this rule during early retirement planning phases when you need a ballpark figure. My younger clients in their 30s and 40s use 25x to set initial goals before refining details later. The rule works perfectly for FIRE enthusiasts who want financial independence before traditional retirement age.

I also apply 25x when evaluating whether someone has saved enough. A quick calculation reveals if you are on track or need to increase contributions. The rule becomes particularly useful when deciding between job offers or business opportunities by quantifying required corpus.

Despite my fondness for this rule I acknowledge its oversimplifications. The calculation ignores individual health conditions that may require higher medical reserves. I have seen how it fails to account for one-time major expenses like children’s weddings or property purchases.

Critical oversight: The rule assumes constant expenses throughout retirement but I observe spending typically drops after 70-75 years before rising again in final years.

The 25x approach also overlooks pension income social security benefits or rental income that reduce corpus requirements. I always adjust the formula to factor in these additional income streams for more accurate planning.

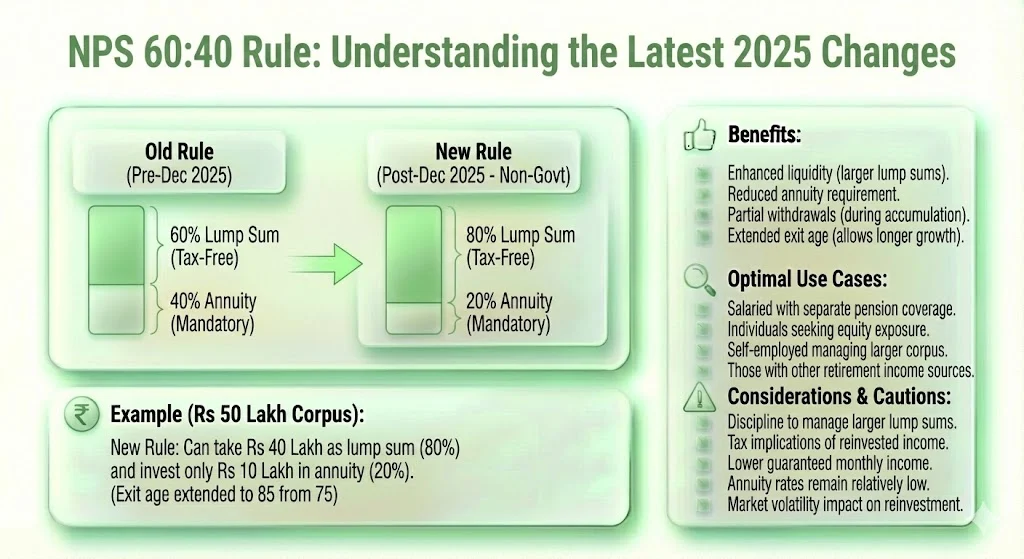

The NPS withdrawal rules have transformed dramatically and I am excited about the new flexibility. The traditional 60:40 rule stated that at age 60 you could withdraw 60% tax-free while 40% had to purchase an annuity. This has changed significantly in December 2025.

I now explain to my clients that non-government NPS subscribers can withdraw up to 80% as lump sum with only 20% mandatory for annuity. This represents a massive shift in retirement planning possibilities. For government employees the old 60:40 split still applies but even that may change soon.

What this means for you:

If you have accumulated Rs 50 lakh in NPS you can now take Rs 40 lakh as lump sum and invest only Rs 10 lakh in annuity. I have seen this change unlock better retirement strategies for many individuals. The exit age has also extended to 85 from 75 giving more control over your money.

The enhanced liquidity stands out as the primary advantage in my experience. My clients appreciate having access to larger lump sums for debt repayment property investment or emergency funds. The reduced annuity requirement addresses a major complaint I heard constantly about forced low-return products.

I also value how the new rules allow partial withdrawals during the accumulation phase. You can now take loans against your NPS corpus for specific needs like medical emergencies or children’s education. The extended exit age means your money can grow longer if you do not need immediate withdrawals.

This updated NPS structure works brilliantly for several scenarios I encounter. If you are a salaried employee with separate pension coverage the high lump sum withdrawal makes NPS more attractive. I recommend it for individuals who want equity exposure with tax benefits during accumulation.

My self-employed clients love the flexibility to manage larger corpus amounts according to their investment expertise. The rule also benefits those with rental income or other retirement income sources who do not need high annuity payouts.

However I must point out potential drawbacks of taking larger lump sums. The discipline required to manage Rs 40 lakh sensibly exceeds many people’s comfort level. I have witnessed retirees make poor investment choices with lump sum amounts leading to financial stress later.

Tax implications matter: While the lump sum is tax-free at withdrawal you need to reinvest wisely to generate tax-efficient income.

The reduced annuity portion means lower guaranteed monthly income which can feel risky for conservative retirees. I also note that annuity rates in India remain relatively low compared to other investment options making the 20% requirement feel like a compromise. Market volatility can impact your reinvested lump sum significantly if you withdraw during downturns.

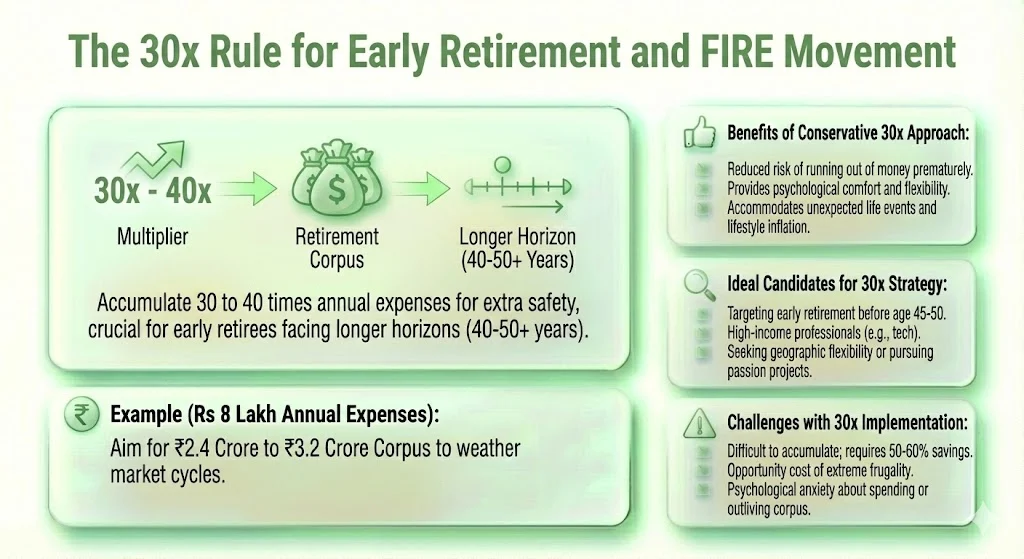

The 30x rule has become my go-to recommendation for aggressive early retirement planning. I developed appreciation for this approach after watching traditional rules fail for early retirees. This rule suggests accumulating 30 to 40 times your annual expenses before retiring which provides extra safety cushion.

When I work with FIRE enthusiasts targeting retirement at 40-45 the longer time horizon demands conservative estimates. If your annual expenses are Rs 8 lakh then aim for Rs 2.4 crore to Rs 3.2 crore corpus. The additional multiplier accounts for longer retirement periods potentially exceeding 40-50 years.

Why the higher multiple matters:

I have calculated that early retirees face sequence of returns risk more severely. Retiring before age 50 means your portfolio must survive multiple market cycles economic recessions and inflation spikes. The 30x cushion helps weather these storms without forcing you back to work.

The primary advantage I observe is the reduced risk of running out of money prematurely. My early retirement clients sleep better knowing they have substantial buffers built in. The extra corpus also provides flexibility to adjust spending during good years while maintaining minimums during downturns.

I appreciate how 30x accommodates unexpected life events that derail perfect plans. Medical emergencies family obligations or economic crises become manageable when you have planned conservatively. The rule also allows room for lifestyle inflation that naturally occurs over decades.

This rule suits individuals I meet who are serious about leaving workforce before 45-50. My tech professionals earning high incomes in their 30s often target 30x for early financial independence. The approach works perfectly for those who want geographic flexibility to travel or relocate internationally.

I recommend 30x for anyone with health concerns requiring early retirement planning. The rule also benefits individuals pursuing passion projects or entrepreneurship that may not generate immediate income. My clients who value time freedom over consumption find this framework ideal.

The obvious difficulty lies in accumulating such large amounts before age 45-50. I see many enthusiastic starters struggle with the discipline required for 15-20 years of aggressive saving. The opportunity cost of extreme frugality during peak earning years can strain relationships and life enjoyment.

Reality check: Achieving 30x requires saving 50-60% of income consistently which most people find unsustainable.

I also notice the psychological challenge of sitting on large corpus without spending freely. The fear of outliving even 30x corpus can create anxiety particularly as withdrawal phases stretch beyond 40 years. Market sequence risk remains despite higher multiples because prolonged downturns still impact larger portfolios significantly.

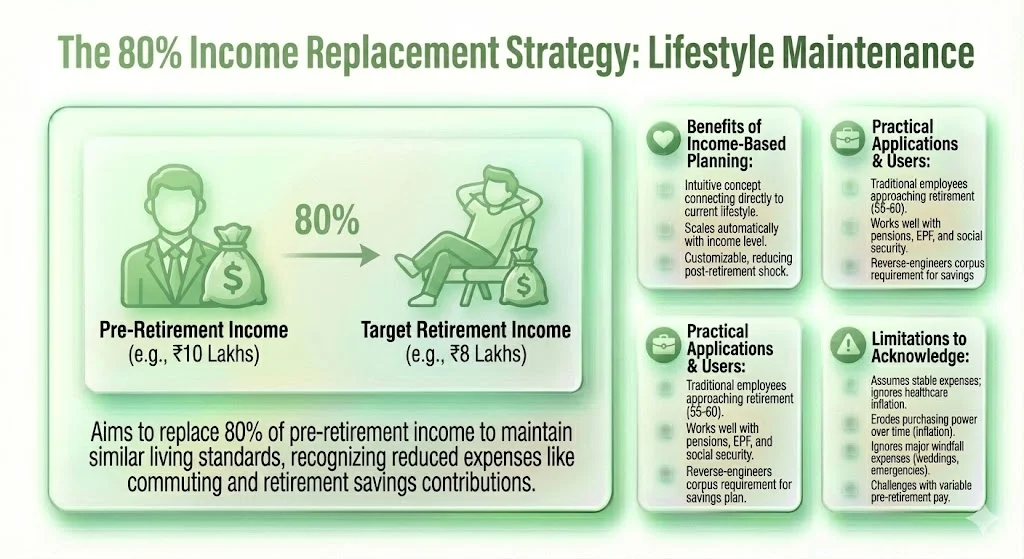

The 80% income replacement rule focuses on lifestyle continuity rather than arbitrary multipliers. I explain to clients that this approach aims to replace 80% of your pre-retirement income to maintain similar living standards. If you earned Rs 10 lakh annually while working target Rs 8 lakh annual income during retirement.

The logic makes sense from my observations. Retirement eliminates certain expenses like commuting costs professional wardrobe and daily lunch expenses. You also stop contributing to retirement savings which frees up significant cash flow. However housing utilities and healthcare costs typically remain stable or increase.

Adjusting the percentage:

I modify this rule based on individual circumstances regularly. Clients who have paid off mortgages and have no dependent children may need only 60-70% replacement. Others with travel plans hobbies or pending family obligations might require 90-100% replacement.

This approach resonates strongly with my clients because it connects directly to their current lifestyle. I find people understand “replace your salary” more intuitively than abstract corpus calculations. The rule automatically scales with your income level making it applicable across economic segments.

I value how this method accounts for lifestyle rather than forcing everyone into identical frameworks. The flexibility to adjust percentages based on personal goals makes planning feel more customized. My experience shows this approach reduces post-retirement shock from sudden income drops.

I use the 80% rule primarily with traditional employees approaching retirement age 55-60. My corporate executives and government employees find this framework comfortable and familiar. The strategy works well when combined with pension income EPF withdrawals and social security benefits.

The rule also helps in reverse engineering your corpus requirement. I calculate what portfolio size generates 80% of current income then work backward to determine required savings rate. This approach works brilliantly for individuals who have 10-15 years until retirement.

I must highlight that 80% replacement assumes relatively stable expenses which rarely holds true. Healthcare inflation runs at 10-15% annually in my experience making medical costs balloon over time. Inflation generally erodes purchasing power meaning 80% today feels like 50% after 15 years.

Major oversight: The rule ignores potential windfall expenses like weddings property repairs or family emergencies that spike spending unpredictably.

I also see challenges when pre-retirement income included significant bonuses or variable pay. Basing calculations on peak earning years can overestimate needs while using average income may underestimate requirements. The rule provides no guidance on asset allocation or withdrawal strategies leaving crucial decisions unaddressed.

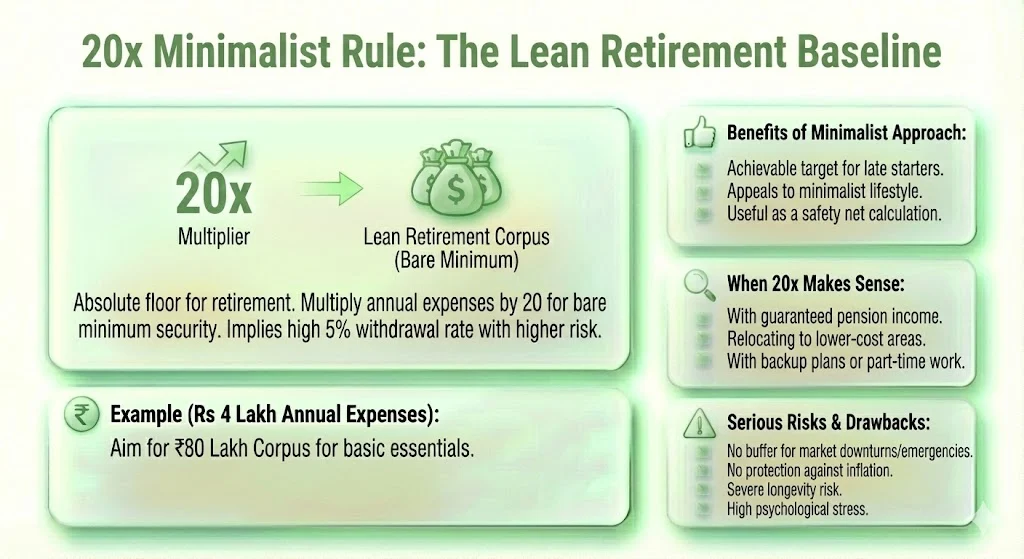

The 20x rule represents what I consider the absolute floor for retirement corpus calculation. I introduce this concept to clients as the minimum viable retirement fund not as an aspirational goal. Multiply your annual expenses by 20 to determine the bare minimum corpus for basic retirement security.

When I work with late starters or lower income individuals this rule provides achievable targets. If you need Rs 4 lakh annually for essentials then Rs 80 lakh corpus forms your baseline. I emphasize this represents lean living without luxuries travel or significant cushions.

The mathematics tells the story:

The 20x multiplier implies 5% annual withdrawal rate which exceeds conventional safe withdrawal recommendations. I calculate this works only if your expenses remain absolutely minimal and you accept higher risk of depleting corpus.

The primary advantage I identify is psychological achievability for those starting late. My 50-year-old clients with limited savings appreciate having a realistic floor target. The rule also appeals to minimalist lifestyle enthusiasts who genuinely prefer simple living over consumption.

I find the 20x framework useful as a safety net calculation. Even aggressive savers benefit from knowing their absolute minimum requirement. The approach can motivate higher savings by showing the gap between minimal survival and comfortable living.

This rule applies in specific scenarios I encounter regularly. My clients with guaranteed pension income can use 20x for supplemental corpus calculation. Individuals planning to relocate to lower cost areas or towns may find 20x adequate.

I recommend this baseline for those with backup plans like reverse mortgages or adult children providing support. The framework also helps evaluate early retirement feasibility when combined with part-time work. My frugal clients who have consistently lived well below their means can sometimes thrive on 20x.

I must stress the substantial dangers of relying solely on 20x for retirement. The 5% withdrawal rate leaves virtually no buffer for market downturns or unexpected expenses. I have seen how single medical emergency can devastate a lean retirement plan.

Critical warning: The 20x approach offers no protection against inflation which will erode purchasing power significantly over 20-30 years.

The rule assumes perfect health stable housing costs and zero family obligations which rarely reflect reality. I observe that longevity risk becomes severe with minimal corpus especially as life expectancy exceeds 75-80 years.

The psychological stress of constantly worrying about money defeats the purpose of retirement entirely. I only present 20x as a last resort baseline never as a recommended target for comfortable retirement.

Tags: Retirement Planning India, NPS Withdrawal Rules 2025, 4% Withdrawal Rule India, FIRE Movement India, Early Retirement Corpus, Financial Independence India, Retirement Income Strategy

Share This Post