Bharat Coking Coal BCCL IPO Listing Puts PSU Stocks Back In Focus: 96% Listing Gain | Image Via Mint

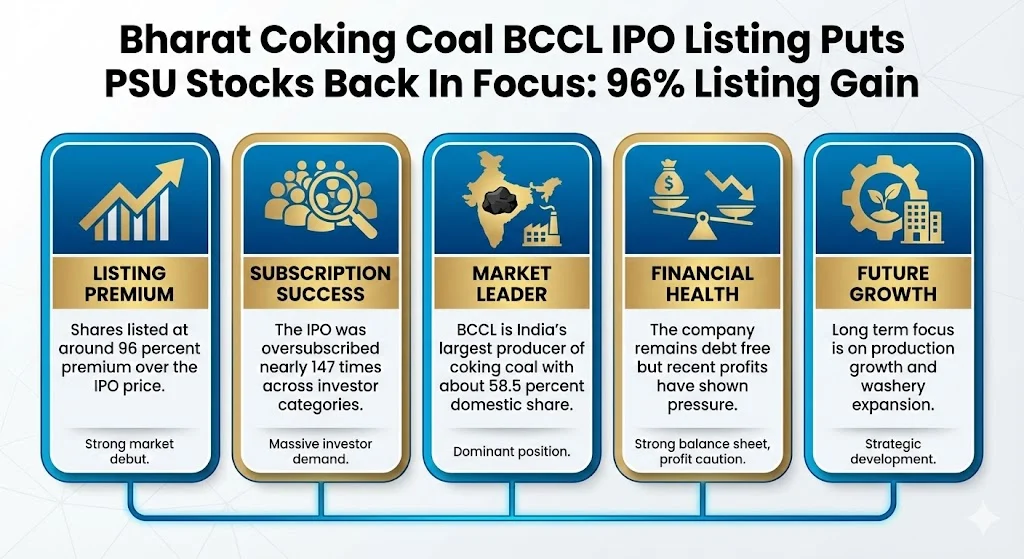

BCCL has moved into the spotlight after its strong stock market debut in January 2026. The company is a key supplier of coking coal for India’s steel industry and operates under the umbrella of Coal India Limited.

Its listing has triggered wide discussion across market forums and social platforms due to the sharp premium and heavy demand seen during the IPO.

The debut is being seen as more than a one day event. It has brought renewed attention to PSU listings and to the role of domestic coking coal in reducing India’s dependence on imports.

Investors are now tracking how Bharat Coking Coal balances near term volatility with long term fundamentals linked to steel and infrastructure growth.

Also Read: Income Tax Refund News 2026: Delays Trigger Nationwide Taxpayer Anger as Pending Cases Cross 50 Lakh

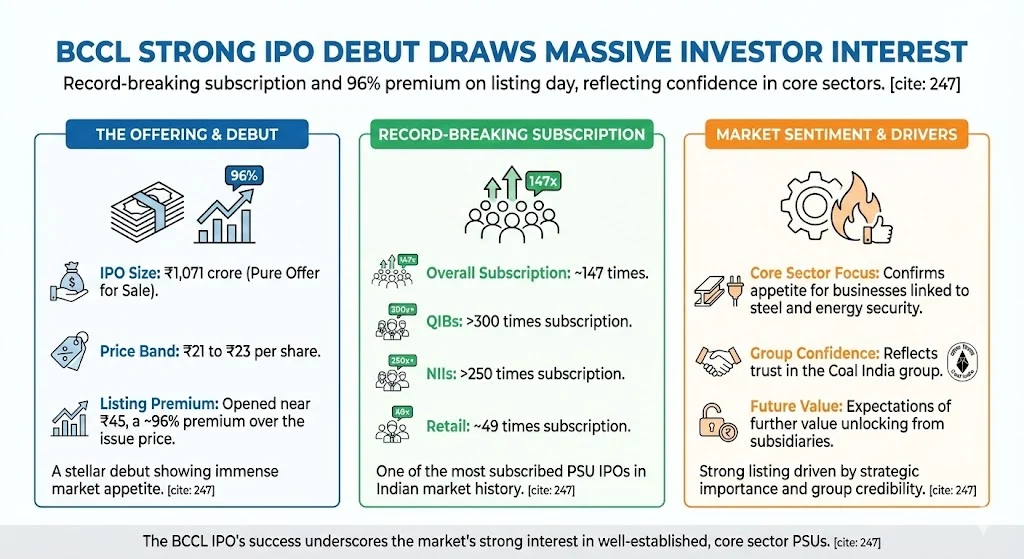

The initial public offering of Bharat Coking Coal was launched as a pure offer for sale worth about ₹1,071 crore. The price band was fixed at ₹21 to ₹23 per share. When trading began on January 19 2026, the stock opened near ₹45 on both NSE and BSE. This translated into a premium of roughly 96 percent over the issue price.

The response during subscription was unusually strong even by PSU standards. The issue was subscribed around 147 times overall. Qualified institutional buyers led the demand with more than 300 times subscription. Non institutional investors followed with over 250 times subscription. Retail participation was also high with nearly 49 times subscription. This made BCCL one of the most subscribed PSU IPOs in Indian market history.

The strong listing confirmed investor appetite for businesses linked to core sectors such as steel and energy security. It also reflected confidence in the Coal India group and expectations of further value unlocking from subsidiaries.

At the IPO price, Bharat Coking Coal appeared attractively valued on its FY25 earnings. Based on that year’s profit, the price to earnings multiple looked modest for a market leader with stable cash flows. However, the near doubling of the share price on listing changed the valuation picture quickly.

Using annualised H1 FY26 earnings, the effective P E multiple rose sharply after listing. This shift has made future profit recovery more important for sustaining the stock price. Investors are now comparing BCCL’s valuation with global coking coal peers and factoring in the cyclical nature of commodity businesses.

The message from the market is clear. The listing premium has priced in a good part of the long term optimism. From here, earnings delivery and cost control will matter more than listing day excitement.

Bharat Coking Coal holds a dominant position in India’s coking coal segment. It contributes close to 58.5 percent of domestic coking coal production. Its operations are concentrated in the Jharia coalfields of Jharkhand and the Raniganj coalfields of West Bengal. These regions are critical for supplying prime coking coal to steel producers.

As of April 2024, the company’s coal reserves were estimated at around 7.91 billion tonnes. Production has shown steady growth in recent years. Output increased from 30.51 million tonnes in FY22 to about 40.50 million tonnes in FY25. The company has outlined plans to reach nearly 56 million tonnes by 2030.

This growth is expected to come from mine expansions, reopening of underground mines, and modernisation of washeries. These steps are aimed at improving recovery rates and product quality.

In FY25, Bharat Coking Coal reported revenue in the range of ₹14,000 to ₹14,600 crore. Profit after tax stood at about ₹1,240 crore. This was lower than FY24 when profits were around ₹1,564 crore. The decline was linked to fluctuations in coking coal prices.

The first half of FY26 showed sharper pressure. Revenue dropped to around ₹5,659 to ₹6,311 crore. Profit after tax fell to nearly ₹124 crore compared to ₹749 crore in the same period last year. Heavy rainfall disrupted mining operations and global coking coal prices remained weak during this period.

Despite this slowdown, the company continues to generate cash and carries no long term debt. Management has indicated that profitability should improve as operational conditions normalise.

One of the key strategic levers for Bharat Coking Coal is its focus on coal washing capacity. Washed coking coal commands significantly higher realisations compared to raw coal. Management estimates that value from washed coal can be up to three times higher in certain cases.

The company plans to double its washery capacity over the coming years. This is expected to support margins and also help domestic steel producers reduce dependence on imported coking coal. India currently imports close to 90 percent of its coking coal needs. Any meaningful reduction in this figure has strategic importance.

From FY27 onward, Bharat Coking Coal is targeting annual profits of over ₹2,000 crore. Achieving this will depend on execution of washery projects, stable production, and supportive pricing.

Before the IPO, Bharat Coking Coal was a wholly owned subsidiary of Coal India. Following the listing, Coal India’s stake has reduced from 100 percent to about 90 percent. This change became effective from January 19 2026.

The reduction in stake does not alter operational control. Bharat Coking Coal continues to function as a subsidiary of Coal India. The listing has however created a separate market identity for the company and allows investors to directly participate in its performance.

The updated shareholding structure reflects the sale of equity shares through the IPO and aligns with the broader monetisation roadmap of the parent group.

Public reaction on X and other platforms has been largely positive. Many retail investors highlighted the near doubling of their investment on listing day. The IPO has often been described as a bumper hit and a major win for PSU investors.

There is also discussion around the long term role of BCCL in India’s steel growth story. Market participants point to its reserve strength, production plans, and strategic relevance under Atmanirbhar Bharat initiatives. Some investors have shared optimistic price targets in the ₹50 range.

At the same time, there are voices urging caution in the short term. Profit booking was visible on the listing day itself, with the stock closing around 10 percent lower than its opening price. Concerns around valuation, earnings volatility, and commodity risks are being flagged by more conservative investors.

The focus has now shifted from listing gains to operational performance. Quarterly results over the next few periods will be closely tracked to see whether profits recover from the H1 FY26 slowdown. Cash flow trends and working capital management are also under watch.

Another factor is broader steel demand and global coking coal pricing. Since BCCL’s fortunes are closely tied to steel production, any slowdown or pickup in that sector will directly influence earnings.

For long term investors, Bharat Coking Coal is being viewed as a play on infrastructure growth and import substitution. For short term traders, volatility around earnings and market sentiment remains a key consideration.

The IPO of Bharat Coking Coal has clearly reignited interest in PSU stocks and resource based businesses. The strong listing reflects confidence in the company’s strategic importance and asset base. At the same time, the sharp re rating has raised expectations from future earnings.

BCCL’s long term story rests on production growth, washery expansion, and its role in supporting India’s steel sector. Near term performance may remain uneven due to external factors. Investors will need to balance the excitement of the debut with a realistic assessment of cyclical risks and execution challenges.

Tags: Bharat Coking Coal, BCCL IPO, PSU stocks, Coal India subsidiary, coking coal India, steel sector stocks

Share This Post