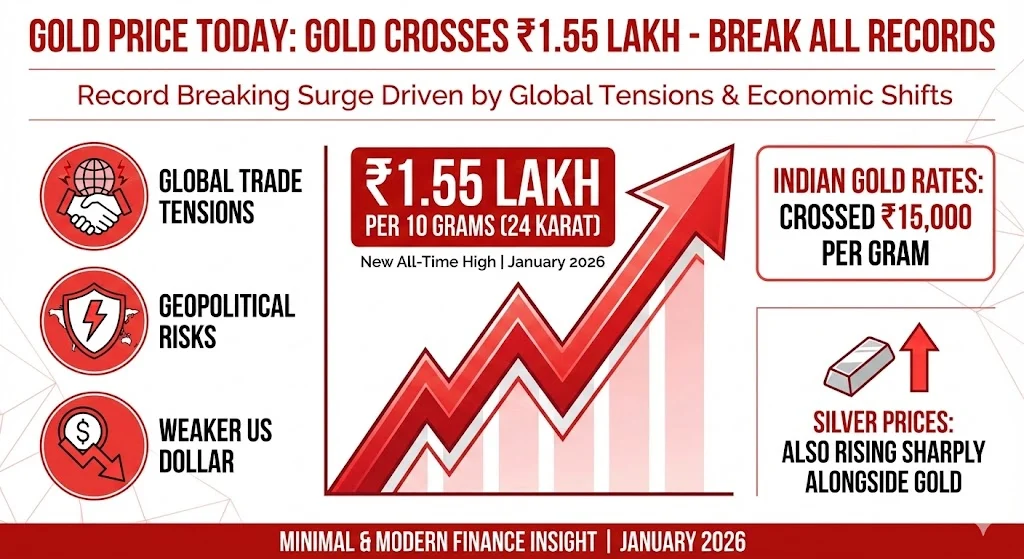

Gold Price Today: Gold Crosses ₹1.55 Lakh - Break All Records

Gold prices today are trading at record levels as the metal continues its sharp upward move in January 2026. Global uncertainty, rising trade tensions, and steady buying from investors have pushed gold to levels that few expected at the start of the year. The rally has been fast, strong, and widespread across international and Indian markets.

In the last few sessions, gold has moved higher almost daily. The pace of the rise has surprised both buyers and traders. While investors see gold as protection during unstable times, consumers in India are feeling the pressure as jewellery prices climb to new highs.

Also Read: Why Market Is Down Today: Trade War Fears Trigger Sell Off

As of January 21, 2026, spot gold is trading in the range of $4,800 to $4,870 per ounce. In early trading sessions, prices crossed $4,871, marking one of the strongest single day gains in recent months. Compared to early January, gold has moved up from the $4,300 to $4,500 zone.

On a year on year basis, gold prices are up by nearly 75 to 77 percent. This scale of growth highlights the strength of safe haven demand across global markets. Investors are moving money into gold as concerns around global stability continue to grow.

Analysts describe the current move as aggressive and unusually fast. Gold has broken multiple resistance levels in a short time. Each breakout has attracted fresh buying interest, adding fuel to the rally.

Indian gold prices have followed the global trend closely. Domestic rates have surged across major cities, including Delhi, Mumbai, and Chennai. The rise has been sharp enough to impact retail demand, especially during the wedding season.

Currently, 24 carat gold is trading above ₹15,000 to ₹15,500 per gram in many cities. The price for 10 grams has crossed the ₹1.55 to ₹1.58 lakh mark. On the commodities exchange, prices have seen daily jumps of ₹4,000 to ₹5,000 per 10 grams on several occasions.

22 carat gold prices are also elevated and are trading above ₹14,200 per gram in most markets. This has made gold jewellery significantly more expensive compared to last year.

| Category | Price Level |

|---|---|

| Spot Gold (Global) | $4,800–$4,870 per ounce |

| 24K Gold India | ₹15,000–₹15,500 per gram |

| 22K Gold India | ₹14,200+ per gram |

| MCX Gold (10g) | ₹1.55–₹1.58 lakh |

| Silver (Global) | $94–$95 per ounce |

Several factors are working together to support higher gold prices. The most important driver is global uncertainty. Trade disputes between major economies, including rising tensions linked to US and EU policy disagreements, have increased risk perception in financial markets.

A softer US dollar has also played a key role. When the dollar weakens, gold becomes more attractive for investors holding other currencies. This has increased international demand for the metal.

Central banks have continued to add gold to their reserves. This steady accumulation has reduced available supply in open markets. At the same time, investors are using gold to balance portfolios as equity markets show signs of stress.

Gold is no longer seen only as a commodity. Many market participants now treat it as a direct hedge against geopolitical risk. Recent price action reflects fear rather than speculation. Investors are willing to pay higher prices to protect capital.

Public sentiment on social platforms shows a mix of excitement and concern. Long term holders are benefiting from rising prices. New buyers, especially in India, are struggling with affordability. Wedding budgets and jewellery purchases are being delayed or scaled down due to the sharp rise.

Traders are also cautious at these levels. While profits are strong, the speed of the rally has raised concerns about short term corrections.

Silver prices have also moved higher alongside gold. Globally, silver is trading near $94 to $95 per ounce. In India, prices have crossed key psychological levels, with reports of silver touching ₹3.3 lakh per kilogram.

The gold silver rally shows broad strength in precious metals. Industrial demand for silver remains steady, while investment demand has picked up sharply. This combination has supported higher prices across both metals.

Market forecasts remain largely bullish for the rest of 2026. Many analysts expect average prices to stay between $4,400 and $5,055 by the end of the year. Some long term projections even point toward $5,000 to $6,000 levels if global risks continue.

However, risks remain. A sudden rise in bond yields or a strong recovery in the US dollar could trigger a correction. Analysts warn that a pullback of 5 to 20 percent is possible after such a steep rally.

Despite these risks, the broader trend remains positive. As long as global uncertainty stays high, gold is likely to remain well supported at elevated levels.

For investors, gold continues to act as a strong hedge against instability. Long term holders have seen significant gains over the past year. Portfolio diversification remains a key reason for continued interest in gold.

For retail buyers, especially in India, timing has become crucial. High prices mean higher entry costs. Buyers may consider staggered purchases or alternative investment options linked to gold rather than physical buying at peak levels.

Gold price today reflects a market driven by fear, protection, and global uncertainty. Whether prices cool off or push higher will depend on how global economic and political events unfold in the coming months.

Tags: gold price today, gold rate today India, MCX gold price, gold price January 2026, silver price today, precious metals news

Share This Post