Income Tax Refund News 2026: Delays Trigger Nationwide Taxpayer Anger as Pending Cases Cross 50 Lakh | Image With Upstox

Income tax refund delays have become one of the most talked about financial issues in India as January 2026 unfolds. Millions of taxpayers who filed their returns on time are still waiting for their refunds, even after months of e verification and zero outstanding demands. What was earlier a routine process of weeks has now stretched into a long and uncertain wait for many.

This situation has triggered strong public reaction across social media platforms, especially on X, where salaried and middle class taxpayers are openly questioning the efficiency and accountability of the income tax system. With Budget 2026 approaching, refund delays have turned into a broader debate on fairness, transparency, and taxpayer rights.

Also Read: Bharat Coking Coal BCCL IPO Listing Puts PSU Stocks Back In Focus: 96% Listing Gain

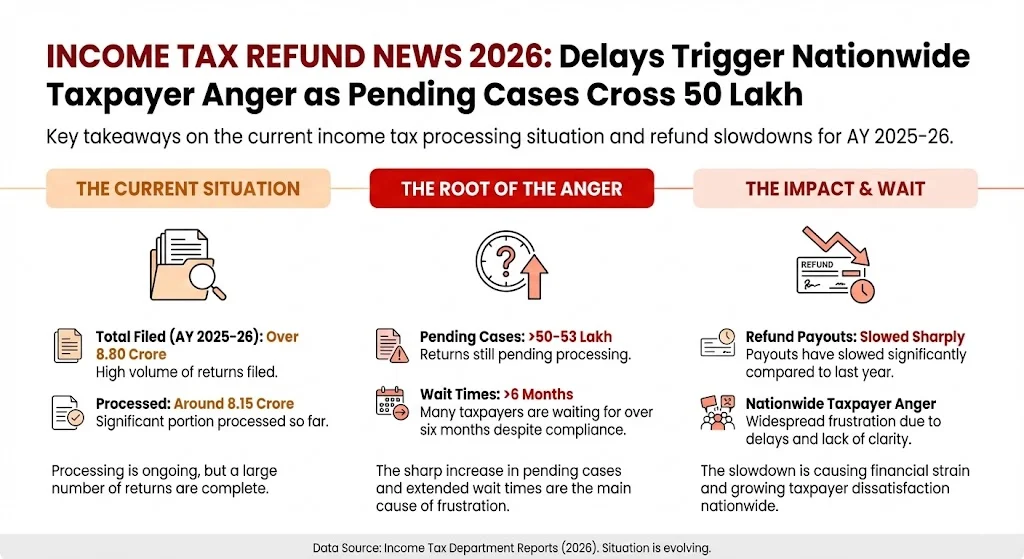

As per the latest available data, nearly 8.80 crore income tax returns have been filed for Assessment Year 2025 26, which relates to Financial Year 2024 25. Out of these, around 8.15 crore returns have already been processed by the Income Tax Department. However, this still leaves over 50 lakh returns pending, many of which involve refund claims.

Several reports earlier in January suggested that pending cases were even higher, ranging between 55 to 61 lakh returns at one point. Although some progress has been made, the pace of processing remains slow, especially for refunds.

For taxpayers who filed as early as July 2025, the delay has now crossed five to seven months. This has added to the frustration, particularly among those who depend on refunds for household expenses, loan repayments, or savings planning.

Another factor adding to public concern is the sharp decline in refund payouts this financial year. During FY 2025 26, the total individual income tax refunds issued so far stand at approximately ₹1,28,374 crore. In comparison, refunds worth about ₹1,71,281 crore were issued during the same period last year.

This marks a drop of nearly 25 percent in refund disbursals. Experts believe this slowdown reflects tighter scrutiny and cautious processing by the department. For taxpayers, however, the lower payout numbers strengthen the perception that refunds are being deliberately delayed.

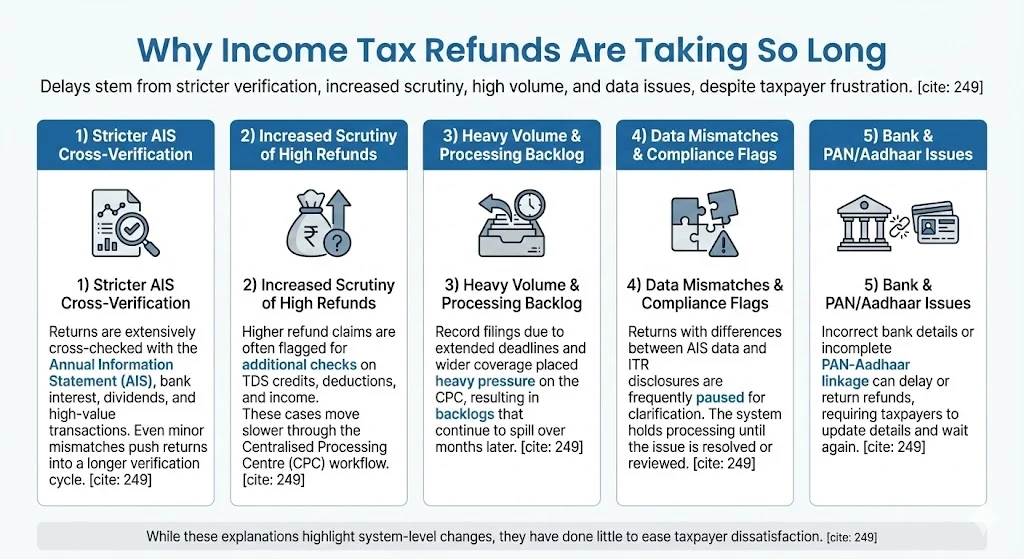

The Income Tax Department and tax experts have pointed to several reasons behind the prolonged delays. While these explanations highlight system level changes, they have done little to ease taxpayer dissatisfaction.

One of the biggest changes in recent years is the deeper use of data analytics. Returns are now extensively cross checked with the Annual Information Statement, bank interest records, dividend income, and high value transactions. Even minor mismatches can push a return into a longer verification cycle.

Returns claiming higher refund amounts are often flagged for additional checks. This includes validation of TDS credits, deductions, and reported income. Such cases move slower through the Centralised Processing Centre workflow.

The assessment year saw a record number of filings due to extended deadlines and wider tax coverage. This surge has placed heavy pressure on the CPC, resulting in backlogs that continue to spill over months later.

Returns with differences between AIS data and ITR disclosures are frequently paused for clarification. Even when the mismatch is minor, the system may hold processing until the issue is resolved or reviewed.

Incorrect bank account details or incomplete PAN Aadhaar linkage can also delay refunds. In some cases, refunds are issued but returned by the bank, requiring taxpayers to update details and wait again.

Under normal circumstances, income tax refunds are expected to be credited within four to five weeks after return filing and verification. This guideline is widely cited by tax authorities and professionals.

However, the law allows the department time until December 31, 2026, under Section 143(1), to complete processing for AY 2025 26. While interest is payable for delays, there are no strong enforcement measures or penalties if refunds are held up for months.

Many taxpayers argue that the interest credited for delays is either minimal or not calculated accurately, reducing its effectiveness as a compensation mechanism.

Social media has become the primary outlet for taxpayer frustration. On X, users have been repeatedly tagging the official income tax handle, asking how long they need to wait for refunds filed in July or August 2025.

Common complaints include statements like filing on time and paying on time but still facing refund delays. Many users point out that while taxpayers face penalties and interest for late payments, the department faces no similar consequences for delayed refunds.

Some users sarcastically describe the situation as the government borrowing money interest free from honest citizens. Others call it harassment of compliant taxpayers, especially salaried individuals who have no scope to delay tax payments.

Poll style posts and threads show a clear pattern. A large majority indicate they have not received refunds, while only a small number confirm receipt after months of waiting or grievance escalation.

Taxpayers facing long delays are advised to contact the Centralised Processing Centre, which handles ITR processing and refunds. Grievances can be raised through the income tax e filing portal or via the e Nivaran system.

However, many complain that grievances are often closed with standard template responses, offering no clear resolution timeline. This has further fueled anger, as repeated follow ups fail to produce results.

Some isolated cases have reported success after filing grievances, with refunds arriving weeks later. These instances are now seen as exceptions rather than the norm.

As Union Budget 2026 approaches, refund delays have become part of the broader tax reform discussion. Experts and taxpayers alike are calling for structural changes to restore confidence in the system.

One key demand is parity between interest charged on tax dues and interest paid on refunds. Currently, interest on refunds is lower and also taxable, which many see as unfair.

There are also calls for fixed processing deadlines, clearer accountability within CPC operations, and stronger safeguards against erroneous demand adjustments.

For many middle class taxpayers, the refund issue has become symbolic of a deeper imbalance in the tax system. Despite contributing consistently, they feel there is little support or responsiveness when delays occur.

While systemic reform takes time, taxpayers can still take certain steps to avoid further delays. Ensuring correct bank details, pre validation of accounts, and prompt response to any notices can help prevent additional holds.

Regularly checking the refund status on the income tax portal and following up through grievances remains the only available option for now. Though not always effective, it helps keep the case active in the system.

The ongoing income tax refund delays have created a visible trust gap between taxpayers and the system. What was once considered a smooth and predictable process is now viewed with anxiety and skepticism.

With over 50 lakh returns still pending and refund payouts lagging behind last year, the issue is unlikely to fade soon. For now, taxpayers are watching closely, hoping that Budget 2026 brings concrete steps rather than assurances.

Also Read: Shadowfax IPO Opens Amid Cautious Optimism From The Market: ₹1,907 Cr IPO Worth the Risk

Tags: income tax refund news, income tax refund delay, ay 2025 26 itr, income tax refund status, budget 2026 tax

Share This Post