Reliance Power Is Down Since 7 Days What Is Pressuring the Stock - Hits Fresh 52 Week Low | Image With Manufacturing Today India

Reliance Power share price has remained under pressure for the last seven trading sessions. The stock has continued to make lower lows and has slipped below important psychological levels. Investors tracking the counter have seen consistent selling with rising volumes, which signals stress rather than healthy consolidation.

As of January 20 to 21, 2026, Reliance Power is trading near the ₹30 mark after touching fresh 52 week lows. The fall has come after months of weakness and has intensified due to regulatory developments, weak long term fundamentals, and negative retail sentiment across the power and midcap space.

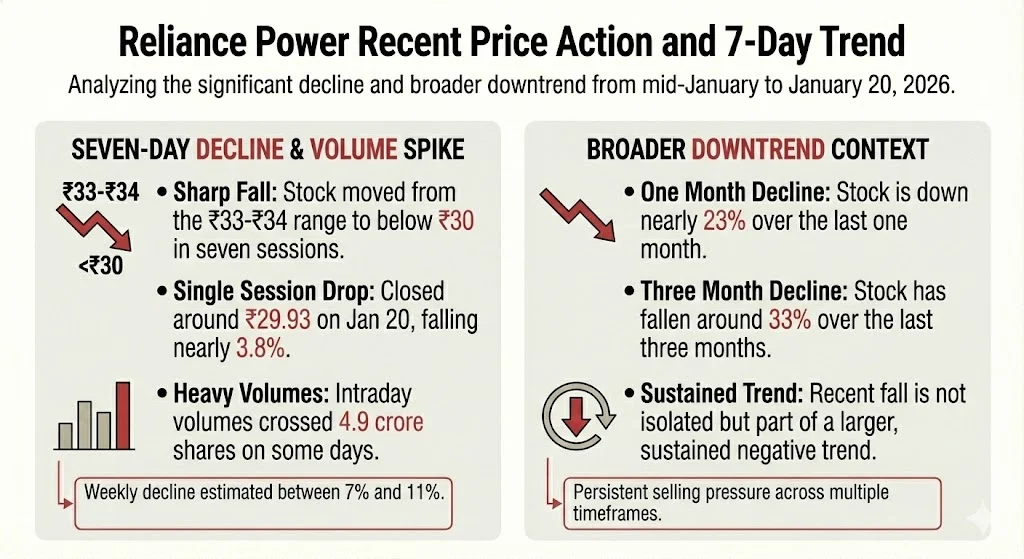

Over the last seven trading sessions from mid January to January 20, 2026, Reliance Power has moved from the ₹33 to ₹34 range to below ₹30. The stock closed around ₹29.93 on January 20 after falling nearly 3.8 percent in a single session. Intraday prices have ranged between ₹29.75 and ₹31.37 with heavy volumes crossing 4.9 crore shares on some days.

The weekly decline has been estimated between 7 percent and 11 percent depending on the reference period. On a broader timeframe, the stock is down nearly 23 percent over the last one month and around 33 percent over the last three months. These numbers highlight that the recent fall is not isolated but part of a larger downtrend.

Also Read: Valor Estate Stock Down for 7 Straight Days as Shares Slip Near 52 Week Lows

Reliance Power has repeatedly made new 52 week lows during this decline. Intraday lows between ₹29.38 and ₹29.66 have been recorded on both NSE and BSE. Breaking a 52 week low is considered a major technical red flag as it signals absence of buying interest at earlier support zones.

The stock is trading well below its 5 day, 20 day, 50 day, 100 day, and 200 day moving averages. This alignment confirms sustained bearish momentum. Technical analysts tracking the stock have pointed out that any recovery attempt faces strong resistance near ₹33 to ₹34, while immediate support remains close to ₹30.

The sharpest leg of the fall came after the company informed exchanges on January 16, 2026, about a SEBI initiated forensic audit. The audit relates to alleged violations under the SEBI Act 1992, SCRA 1956, and the Companies Act 2013.

This announcement triggered panic selling and pushed the stock down by nearly 8 percent in a single session. Regulatory scrutiny often creates uncertainty for investors, especially in retail dominated stocks. Until there is clarity or a clean outcome, such news tends to cap upside and increase volatility.

Despite occasional positive quarterly numbers, Reliance Power continues to struggle on long term financial metrics. Over the past five years, the company has reported a negative operating profit CAGR of around minus 7 percent. This indicates difficulty in building sustainable earnings from core operations.

Debt levels also remain a concern. The Debt to EBITDA ratio is close to 9.8 times, which reflects high leverage relative to earnings. Return on Equity remains very low at around 0.5 percent on average, showing limited value creation for shareholders. These factors continue to weigh on institutional interest.

In the September 2025 quarter, Reliance Power reported a sharp jump of over 95 percent in net profit on a year on year basis. Profit after tax stood near ₹87 crore, marking the third consecutive profitable quarter. Interest coverage ratios and ROCE showed some improvement from a low base.

However, these improvements have not translated into share price stability. The market appears to be focusing more on long term balance sheet strength, regulatory risk, and historical volatility rather than short term earnings growth. As a result, positive quarterly data has failed to reverse the broader downtrend.

One notable feature of the recent decline has been the sharp rise in trading volumes during down days. High volumes combined with falling prices usually indicate panic selling or forced exits. Reliance Power has one of the highest retail shareholding bases in the power sector, which increases volatility during negative news cycles.

Low institutional holding further adds to price instability. Domestic mutual funds hold less than 1 percent stake in the company, which signals cautious positioning by large investors. This leaves the stock vulnerable to sharp moves driven by retail sentiment.

Public sentiment on Twitter between January 14 and January 21, 2026, has been largely negative. Many users have classified Reliance Power as a high risk penny style stock with a history of deep drawdowns. Comparisons have been drawn with stocks like Vodafone Idea, YES Bank, Suzlon Energy, and Paytm where retail investors have faced prolonged losses.

Common themes include warnings that a low share price does not mean low risk. Several posts highlight that stocks can fall 80 to 95 percent from peaks despite trading at single digit or low double digit prices. There is also repeated mention of retail investors being trapped due to heavy past buying.

Reliance Power has underperformed both the broader market and the power sector. Over the last one year, the stock has delivered negative returns of over 24 percent, while the Sensex and BSE 500 have posted positive gains. Even within the power sector, the stock has lagged peers during market recoveries.

Retail focused stocks across midcap and smallcap indices have seen sharp corrections over the past year. Stocks with high narrative value and weak fundamentals have been hit the hardest. Reliance Power falls into this category due to its volatile history and leverage concerns.

The stock faces multiple headwinds at the same time. Regulatory uncertainty from the forensic audit remains unresolved. Technical indicators continue to point downward. Long term fundamentals offer limited confidence. Retail sentiment remains cautious with more focus on capital protection than fresh buying.

Analysts tracking the counter suggest that unless a strong positive trigger emerges, such as regulatory clarity or significant balance sheet improvement, the stock may continue to struggle. Any bounce is likely to face selling pressure near previous support levels that have now turned into resistance.

One recurring question among retail investors is whether the stock looks cheap near ₹30. Historical data shows that Reliance Power traded near ₹3.4 in early 2021 and later surged sharply. However, the stock also peaked near ₹76 in mid 2025 before losing over 60 percent of its value.

This history reinforces the idea that price alone should not be the basis for investment decisions. Volatility, governance risk, and financial strength play a much bigger role in determining long term outcomes.

Reliance Power being down for seven straight sessions reflects more than just short term weakness. The fall is driven by a mix of regulatory concerns, fragile fundamentals, technical breakdown, and negative retail sentiment. While the company has shown some operational improvement in recent quarters, the market remains unconvinced.

Until selling pressure eases and clarity emerges on regulatory issues, the stock is likely to remain volatile. Investors tracking the counter should focus on risk management and avoid decisions based purely on past rallies or low absolute price levels.

Tags: Reliance Power, RPOWER share price, power sector stocks, Indian stock market, retail investor stocks, midcap stocks

Share This Post