Shadowfax IPO, logistics IPO, Indian stock market, e commerce logistics, IPO analysis, last mile delivery | Image Via YourStory

The Shadowfax IPO opened for subscription on January 20, 2026, and has quickly become a major discussion point in India’s logistics and e commerce ecosystem. The company operates at the centre of last mile delivery and quick commerce, supporting many of the platforms used daily by Indian consumers.

Shadowfax Technologies is often described as the Uber of logistics due to its tech driven and asset light delivery model. With profitability achieved in a sector known for heavy losses, the IPO has drawn attention from retail investors, institutions, and long term market watchers alike.

| Particulars | Details |

|---|---|

| IPO opening date | January 20, 2026 |

| IPO closing date | January 22, 2026 |

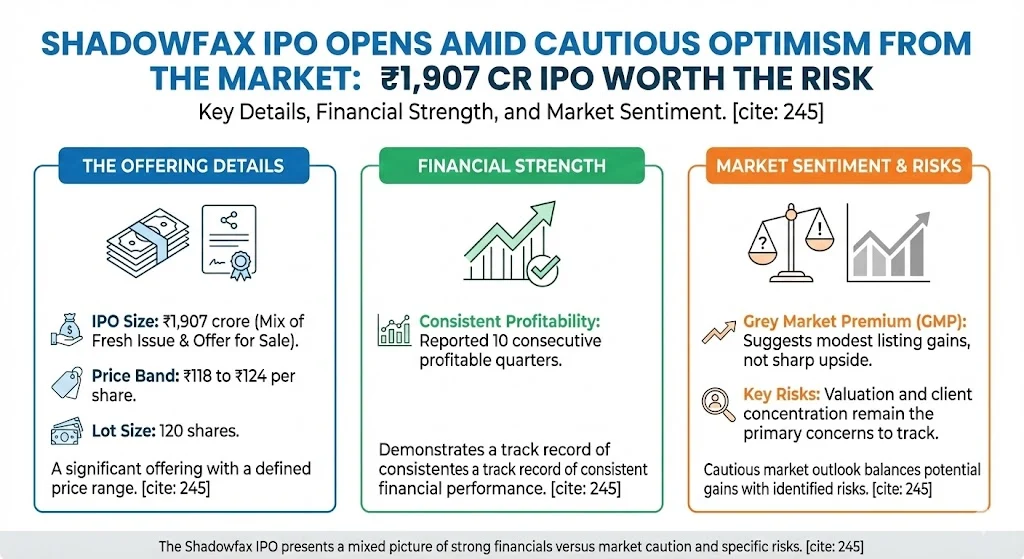

| Price band | ₹118 to ₹124 per share |

| Issue size | ₹1,907 crore |

| Fresh issue | ₹1,000 crore |

| Offer for sale | ₹907 crore |

| Lot size | 120 shares |

| Minimum investment | ₹14,880 |

| Tentative listing | January 28, 2026 |

| Stock exchanges | BSE and NSE |

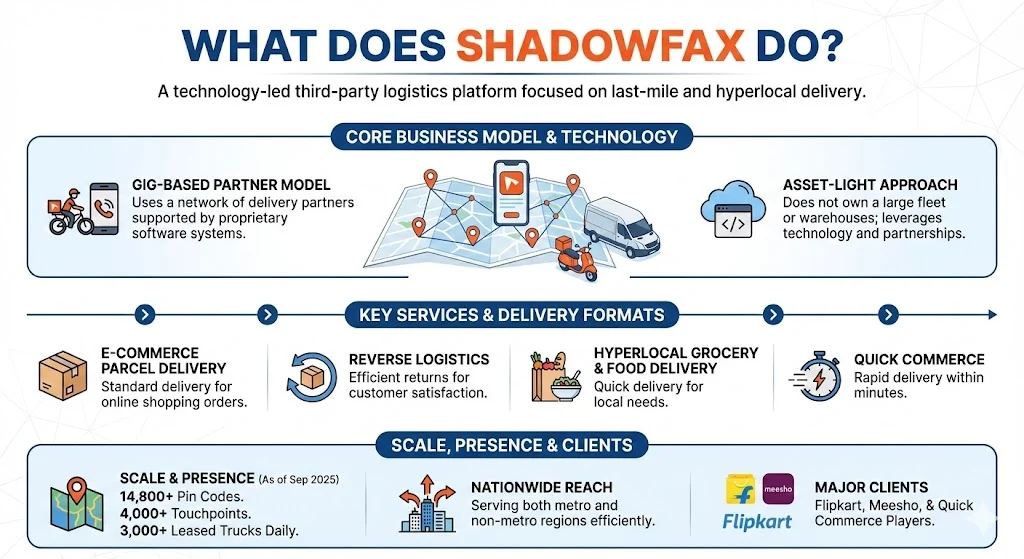

Shadowfax Technologies Ltd operates a technology led third party logistics platform focused on last mile and hyperlocal delivery. Instead of owning a large fleet of vehicles or warehouses, the company uses a gig based partner model supported by proprietary software systems.

Its services cover multiple delivery formats. These include standard e commerce parcel delivery, reverse logistics for returns, hyperlocal grocery and food delivery, and quick commerce orders that promise delivery within minutes. The company serves large platforms such as Flipkart, Meesho, and several quick commerce players.

As of September 2025, Shadowfax had presence across nearly 14,800 pin codes with over 4,000 touchpoints and more than 3,000 leased trucks operating daily. The scale allows the company to serve both metro and non metro regions efficiently.

Also Read: Income Tax Refund News 2026: Delays Trigger Nationwide Taxpayer Anger as Pending Cases Cross 50 Lakh

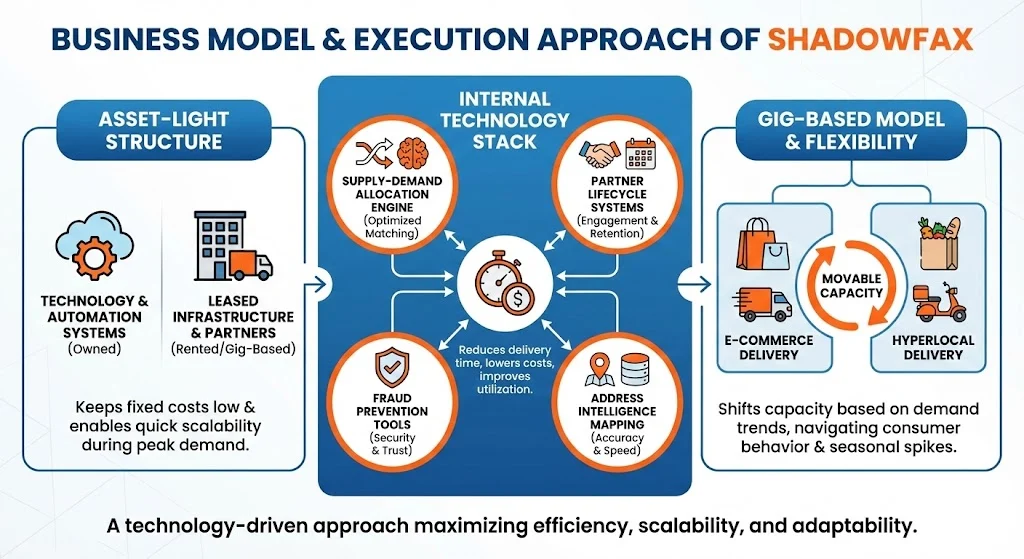

Shadowfax follows an asset light operating structure. It owns technology and automation systems while leasing physical infrastructure and relying on delivery partners. This approach keeps fixed costs relatively low and allows quick scaling during peak demand periods.

A large part of operational efficiency comes from its internal technology stack. This includes a supply demand allocation engine, delivery partner lifecycle systems, fraud prevention tools, and address intelligence mapping. These systems help reduce delivery time, lower costs, and improve partner utilisation.

The gig based model also allows Shadowfax to move capacity between e commerce and hyperlocal segments based on demand trends. This flexibility has helped the company navigate shifts in consumer behaviour and seasonal order spikes.

Shadowfax has shown strong revenue momentum over the past few years. Revenue growth stood at around 68 percent year on year in the first half of FY26. The company has also improved its market share in express logistics from about 8 percent earlier to nearly 23 percent in recent periods.

More importantly, the company has completed a visible turnaround in profitability. After reporting losses earlier, Shadowfax posted a net profit of ₹6.4 crore in FY25. Profitability continued into FY26 with around ₹21 crore in net profit reported in the first half alone.

The company has now delivered 10 consecutive profitable quarters. This shift is seen positively as logistics remains a thin margin business where scale and cost control are critical.

The IPO consists of both a fresh issue and an offer for sale. The fresh issue of ₹1,000 crore will be used to strengthen the company’s operational capabilities.

A significant portion will go towards expanding network infrastructure, including sort centres and first mile facilities. Funds are also earmarked for lease payments on new centres and improving processing efficiency. Remaining capital will support brand building, growth initiatives, and general corporate purposes.

The offer for sale component allows early investors to partially exit while retaining exposure to future growth. Founders are not selling shares, which has been noted positively by market participants.

The grey market premium for Shadowfax IPO has ranged between ₹6 and ₹10 in the days leading up to the issue opening. This translates to a premium of roughly 5 to 8 percent over the upper price band.

Earlier indications showed higher GMP levels, but these have cooled as broader market sentiment turned cautious. Current estimates suggest a possible listing price in the range of ₹130 to ₹134 if conditions remain stable.

Market participants view the GMP trend as a signal of modest but positive debut expectations rather than aggressive listing gains.

Shadowfax raised around ₹856 crore from anchor investors ahead of the IPO. The anchor book included domestic mutual funds such as Nippon India, ICICI Prudential, and HDFC Mutual Fund. Global institutions including Bank of America, HSBC, and Morgan Stanley also participated.

This level of institutional participation is seen as a vote of confidence in the business model and long term prospects. Many observers consider anchor backing as an indicator of valuation comfort among large investors despite sector risks.

Client concentration remains one of the most discussed risks. A large portion of revenue comes from a small set of key clients. Any reduction in volumes from a major client could impact growth and profitability in the short term.

Margins in last mile logistics are thin by nature. Rising competition, higher incentive costs for delivery partners, and fuel or regulatory pressures can quickly affect earnings. Loss or damage costs also form a meaningful expense line.

Valuation is another concern. On traditional earnings metrics, the IPO appears expensive. While some analysts prefer price to sales valuation for high growth logistics firms, comparisons with listed peers like Delhivery highlight limited margin for error.

Public commentary on social platforms reflects a balanced view. Many investors admire Shadowfax for achieving profitability in a loss heavy sector and scaling rapidly across cities. The asset light model and exposure to India’s consumption economy are viewed as long term positives.

At the same time, caution exists around valuation multiples and dependence on a few clients. Short term traders appear less enthusiastic due to moderate GMP levels, while long term investors are watching execution consistency closely.

Overall sentiment leans positive for those with a higher risk appetite and longer investment horizon, especially those bullish on India’s e commerce and quick commerce expansion.

The Shadowfax IPO offers exposure to a critical layer of India’s digital commerce infrastructure. The company has demonstrated growth, improved market share, and achieved profitability at scale.

However, valuation comfort, margin stability, and diversification of client base will be key factors post listing. For conservative investors, tracking quarterly performance after listing may offer better clarity. For high risk long term investors, Shadowfax represents a focused bet on logistics and consumption growth in India.

Also Read: Bharat Coking Coal BCCL IPO Listing Puts PSU Stocks Back In Focus: 96% Listing Gain

Tags: Shadowfax IPO, logistics IPO, Indian stock market, e commerce logistics, IPO analysis, last mile delivery

Share This Post