Valor Estate Stock Down - For 7 Straight Days As Shares Slip Near 52 Week Lows | Image With Business Today

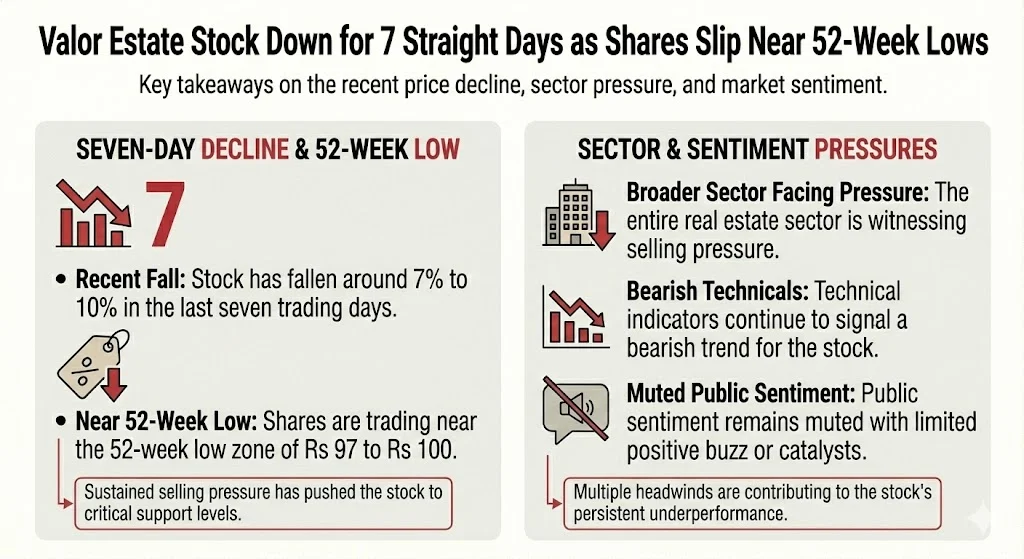

Valor Estate Limited has remained under pressure in recent trading sessions. The stock has declined for nearly seven consecutive days and is now trading close to its yearly lows. Market participants are closely tracking the counter as weakness in the real estate sector combines with company specific concerns. The recent move has shifted short term sentiment to cautious and risk averse.

The stock has seen sharp price erosion in January 2026. Despite a small intraday recovery in the last session, the broader trend remains negative. Investors are now assessing whether the current zone offers stability or signals deeper trouble ahead.

Valor Estate Limited closed around Rs 100.49 on the NSE on January 21 2026. This marked a gain of about 2.19 percent on the day. The intraday range stood between Rs 97.42 and Rs 102.34. While this bounce provided temporary relief, it came after a steady decline over the previous week.

Over the last seven days, the stock has dropped in the range of 7 percent to 10 percent across multiple market reports. The decline has pushed the stock to fresh 52 week lows. Earlier in the month, the price was trading above Rs 120, highlighting the speed of the correction.

From a broader view, the stock is down around 15 to 18 percent in the past one month. Over three months, losses are estimated between 32 and 35 percent. On a one year basis, Valor Estate has corrected close to 40 to 42 percent. This places the stock firmly in a sustained downtrend.

| Metric | Value |

|---|---|

| Recent Close | Rs 100.49 |

| Day High | Rs 102.34 |

| Day Low | Rs 97.42 |

| 7 Day Change | -7% to -10% |

| 1 Month Change | -15% to -18% |

| 1 Year Change | -40% to -42% |

| 52 Week High | Rs 252.67 |

| 52 Week Low Zone | Rs 97 to Rs 100 |

The weakness in Valor Estate is not isolated. The real estate sector has faced selling pressure in recent weeks. After a strong rally earlier in the year, many realty stocks have seen profit booking and correction. Rising interest costs and concerns around demand momentum have weighed on the sector.

Construction and real estate stocks have underperformed the broader market in January 2026. Several counters have broken key support levels. This has led to cautious positioning by traders and short term investors. Sector wide weakness often amplifies stock specific declines, which appears to be the case for Valor Estate.

Apart from sector trends, company level issues have also contributed to the decline. Market analysts have pointed to revenue contraction in recent financial periods. Sales de growth in some segments has raised concerns around near term earnings visibility.

High interest expenses remain another area of focus. In a rising rate environment, leveraged balance sheets attract higher scrutiny. Although the debt equity ratio has shown moderation in recent quarters, the overall perception around financial risk has not fully improved.

Valuation has also emerged as a concern. Despite the sharp correction, some investors believe the price to sales ratio still does not fully reflect expected growth. This mismatch between valuation and growth expectations has kept buyers cautious.

Promoter share pledging continues to be an important factor for Valor Estate. As per the latest available data, promoter pledged holding stands at around 29.09 percent in the September 2025 quarter. This is lower than the 37.3 percent seen in the June 2025 quarter, indicating some reduction.

While the decline in pledged shares is a positive sign, the overall level remains high. In falling markets, high pledge ratios often add pressure due to fears of forced selling. This aspect has kept risk perception elevated among market participants.

From a technical standpoint, the stock continues to show negative momentum. Valor Estate is trading below all key moving averages including short term and long term averages. This reflects sustained selling pressure and lack of trend reversal signals.

Breaking to new lows has triggered stop losses for many traders. Momentum indicators remain on the bearish side. Until the stock forms a stable base or shows higher highs, technical traders are likely to stay cautious.

Support is currently seen in the Rs 97 to Rs 100 zone. This area has witnessed some intraday buying interest. However, a decisive break below this range could open further downside. Resistance on the upside is placed near Rs 110 and Rs 120 levels.

Public discussion around Valor Estate has been relatively limited in recent days. Unlike some high profile corrections that trigger strong reactions on social platforms, this decline has not generated widespread chatter.

Recent scans of discussions show that mentions of Valor Estate are sparse and often mixed with unrelated contexts. There is no visible retail investor outrage or aggressive dip buying narrative. Sentiment around similar real estate and value stocks remains cautious.

Some long term investors have expressed views around potential mean reversion if sector conditions improve. Others believe that recovery will depend heavily on execution and balance sheet stability. Overall sentiment remains neutral to bearish in the short term.

Valor Estate had completed a major corporate restructuring in 2025 through the demerger of its hospitality business. The hospitality arm was transferred to a separate listed entity, Advent Hotels International Limited. Shareholders received equity shares in the new company as part of the arrangement.

At the time of the listing of Advent Hotels, Valor Estate shares were trading at significantly higher levels. While the demerger was viewed as a strategic move to unlock value, subsequent market conditions have diluted the near term impact.

The focus has now shifted back to the core real estate business. Investors are watching how the company deploys capital and improves operational performance post restructuring.

When compared with benchmark indices, Valor Estate has significantly underperformed. While major indices have shown relative stability, the stock has continued to slide. Over the past year, benchmark indices have delivered positive returns, while Valor Estate has seen deep losses.

This underperformance highlights the stock specific challenges faced by the company. It also reflects reduced investor appetite for mid and small cap real estate names during market corrections.

Going forward, investors will track a few key triggers. Quarterly earnings updates will be closely watched for signs of revenue stability or recovery. Any reduction in interest costs or improvement in cash flows could support sentiment.

Movement in promoter pledge levels will also remain in focus. Further reduction could ease risk concerns. Sector level cues such as policy support or demand revival could also influence price action.

In the short term, price behavior near the Rs 100 zone will be critical. Sustained holding above this level may signal temporary stabilization. A breakdown below could extend the downtrend further.

The recent seven day decline in Valor Estate stock reflects a mix of sector weakness, company specific challenges, and bearish technical signals. Trading near 52 week lows has put the stock under close watch. While there are isolated signs of support near current levels, overall sentiment remains cautious.

Until clearer signs of fundamental improvement or technical reversal emerge, the stock is likely to remain volatile. Investors are adopting a wait and watch approach as the real estate sector navigates a challenging phase in early 2026.

Tags: Valor Estate, DB Realty, real estate stocks, Indian stock market, NSE stocks, midcap stocks

Share This Post